Shorting frontside parabolic moves when trying to grow a small trading account should be AVOIDED like the plague. Derrick said it the best

“I suck suck at shorting frontside need to focus on back side. I told my roommate would you rather fight Mike Tyson in round 1 or round 10? I answered my own question. Lesson learned.”

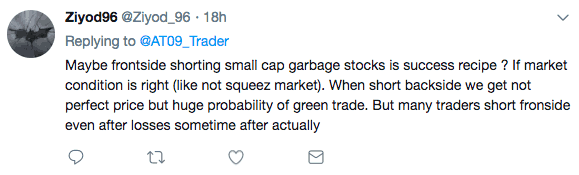

He is 100% right. The only reason why traders short a parabolic move is because they get FOMO and too overconfident // they like taking a starter into it to get a feel on how the stock is going to react. Wouldn’t you rather have a bigger probability of a green trade rather than the possibility of the stock continuing to run? I am guilty of it too. Im not perfect, but when I short into a parabolic its with 1/10 of my normal size and I am quick with exits like a scalp. There is NO POINT in trying to find the top on a stock. Usually the big money is made when traders pile drive like a bulldozer into a stock once that “kiss of death” candle comes along. AVOID FRONTSIDE. AVOID FRONTSIDE. AVOID FRONTSIDE.

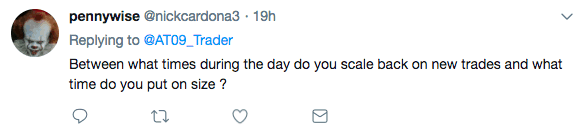

Timing is very important when trading. This is a great blogpost from @EpicaCapital on it. http://www.siliconinvestor.com/readmsg.aspx?msgid=29390810 .. but basically from 9:30am-11:00am is where I execute my plan from the morning and have most of my size on trades. After 11:00am-12:00pm I start to trim down positions if they’re working against me // or add hard to my winner. All depends on the setup and the way the stock is reacting. From 12:00pm-2:00pm I watch how the stock is trading during the lull. Most of the time stocks tend to trap and “zombie” back up on air around this time so I avoid placing new trades unless another perfect setup comes along (rare). From then on until the close I am once again trimming off for gains // or adding more to my positions for a swing into the next morning. I know it sounds so easy, trust me, easier said than done but the key is ALWAYS adding to your winners. Timing is VERY important don’t get me wrong, but the thing more important than timing is position sizing. If you’re in a losing trade from 9:40am-2:00pm and “hoping it comes back” you’ve already lost. Rip the bandaid off, eat the pain, and move on and focus on something better.

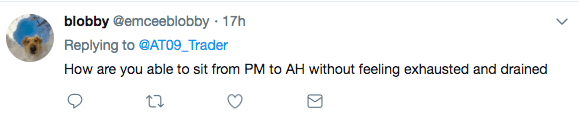

First of all, most of the days I am drained once the bell rings at 4:00pm like everyone else. But the reason I’m even able to sit from 7:00am-4:00pm (9 hours) is because I fucking love what I do. It’s that simple. I eat, sleep, drink, fuck thinking about trading. Its my passion and I am so totally in love with every aspect of it. In life, or in any business, if you don’t LOVE what you do with every bone in your body you have no chance against someone like me who loves the game. I try my best to not be sitting down at the screens all day from open to close because thats insane for anyone. You would start to get cabin fever. Usually during lull I like to leave and pickup lunch just so that I have an excuse to get up, walk around, get some air and clear my thoughts. Obviously on big action days I skip lunch and just focus, but most days are not like that. I also have multiple trading partners // friends that help pass the time with jokes and other things along those lines which helps. The key is trading is to NOT be alone. For so long I thought the key was just to be silent and do your own thing. But I’ve learned through personal experience that my trading not only got better when I started talking to more people, but I also felt more sane and down to earth at the end of the day rather than a zombie. Balance is the key to everything. Get more sleep, get more air, don’t force yourself to stare at a screen for 9 hours a day without moving. Its okay to take a 10 min coffee break and recharge with lunch every day.

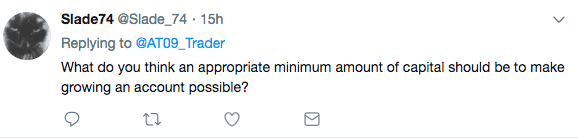

I personally believe that starting with anything less than $5,000-$10,000 is very difficult. Trading is not easy. Don’t believe anyone on the internet who says they can help you turn $500 into $50,000 by buying their product. Its just NOT TRUE. If you start with $1,000 not only will fees kill you alive you also have no wiggle room to be wrong once a trades goes against you. No one is PERFECT with their entries. Trading is all about trial, error and pattern recognition. The bigger your bankroll is the easier it becomes (if you know how to control it). I always suggest paper trading first just so that you can get a feel for what the market is really like. Then once you feel you’re starting to find success open a trading account with $500 not because you think you’ll become a millionaire with that number, but rather with the expectation of blowing it up. There is no better way to learn how the market works than with real money on the line. With paper trading you don’t have the emotional aspect of your real money on the line so its a game. When you start to lose actual money it all changes. I don’t know ONE trader who hasn’t blown up their account when first starting. But IMO its better to consistently blowup five $500 accounts than one $2500 account because each time you lose and blow up you learn something different that will help you improve. Then once you are ready, have a strategy, stop blowing up, you can wire in $5,000 and start.

**If I didn’t answer your question this time be sure to send it in again for next weeks blog**

Investors Underground [Discounted Memberships]: https://investorsunderground.com/s/XmXLj

We put all the FREE WEBINARS Dante & I have done so far on one page for everyone. Enjoy! investorsunderground.com/s/3EOJG

Recent Blogs + FREE Webinars:

My Investors Underground Interview

Setting Stops & Trade Management

Conviction + Sizing + Why 90% Of Traders Fail

Glad you do this Alex, the Q & A’s. So much value IU and you continue to offer