Textbook Trading is our introductory day trading course for traders looking to give themselves an edge in the markets. The course is an amalgamation of years of tested day trading strategies, lessons, and rules. If you haven’t watched Textbook Trading yet, we highly recommend you do. We also recommend checking out our free day trading course (which provides more actionable takeaways then a lot of paid courses on the market).

Today, we are going to cover some key lessons from Textbook Trading. These lessons can be applied to your daily trading and will help you become a better trader.

Supply and Demand

Supply and demand levels control the stock market. Many new traders come to the stock market wondering WHAT causes a stock price to go up and down. To put it simply, supply and demand. Supply is represented by sellers and demand is represented by buyers.

When demand exceeds supply, a stock’s price goes up.

When supply exceeds demand, a stock’s price goes down.

Price will constantly fluctuate until an equilibrium is reached (supply = demand).

As a day trader, you want to pay attention to supply and demand levels before entering a trade. Focus on whether there are more sellers or buyers, as this can be predictive of a stock’s future price movement.

You can analyze supply and demand levels by looking at a level 2 screen or analyzing a stock’s volume on a chart.

Gauging supply/demand levels with certainty is not a simple task, but you won’t be making decisions solely off of this information. Your goal is to get a basic understanding of buyer and seller behavior.

Here is a free clip from Textbook Trading that goes into more detail on supply and demand:

Price Magnets

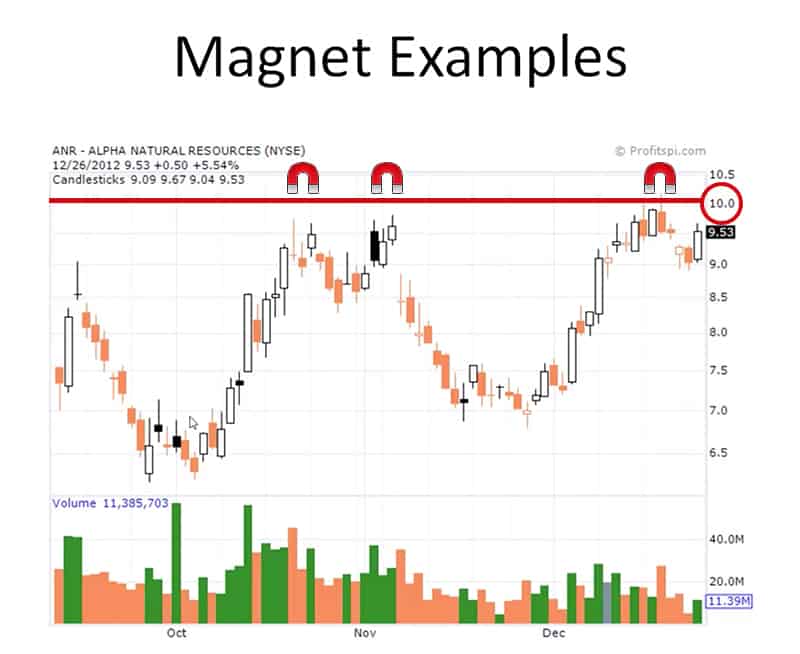

Day traders are constantly analyzing charts looking for support and resistance levels. We generally reference historical trading data to better understand key support and resistance levels. It’s also important to think about psychological support/resistance levels. We call these levels “magnets” because a stock is often pulled to these prices. Magnet levels generally exist at whole and half dollar marks. For example, if a stock, is at $1.80/share, we can assume there may be some resistance around $2, even if it has never been confirmed on the chart before.

This happens because many traders and investors set their buy/sell orders at whole and half dollar marks. As traders, we can use these levels to anticipate future trading behavior and plan our risk accordingly.

Former Runners

Former runners are stocks that have experienced significant price runs in the past. These stocks can be more likely to run in the future for two reasons:

- We’ve already seen proof that the stock can run. Assuming there are no significant changes to the stock’s share structure, the stock has the ability to experience high volatility given a certain level of volume.

- Traders are familiar with these tickers. If a stock runs from $3 to $10 in a few days, traders tend to remember it. This means they may be more likely to either continue watching the stock OR pay more attention when the stock shows up on a scanner.

We do not keep a list of former runners. You will remember some if you have been trading for awhile, and you can always reference the stock’s chart if you are unsure.

Gearing/Perking

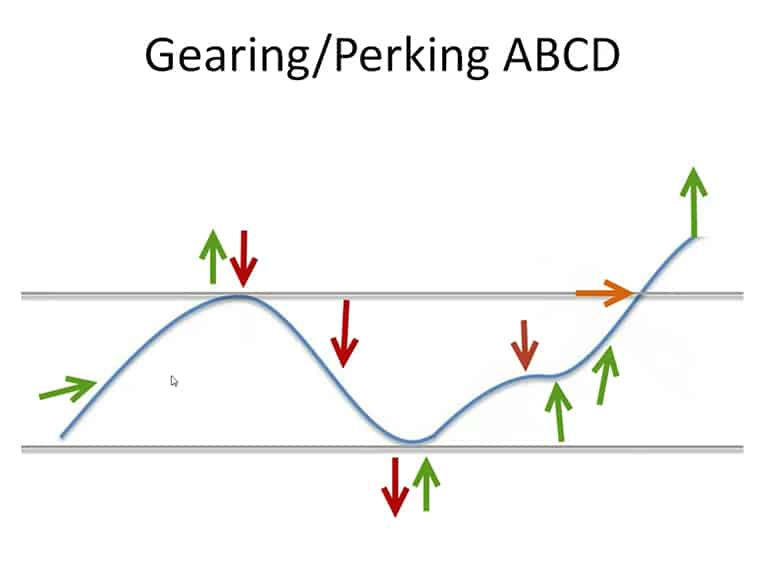

Gearing and perking behavior can allude to a change in momentum in a stock. Look at the chart below to get a better understanding of the concept.

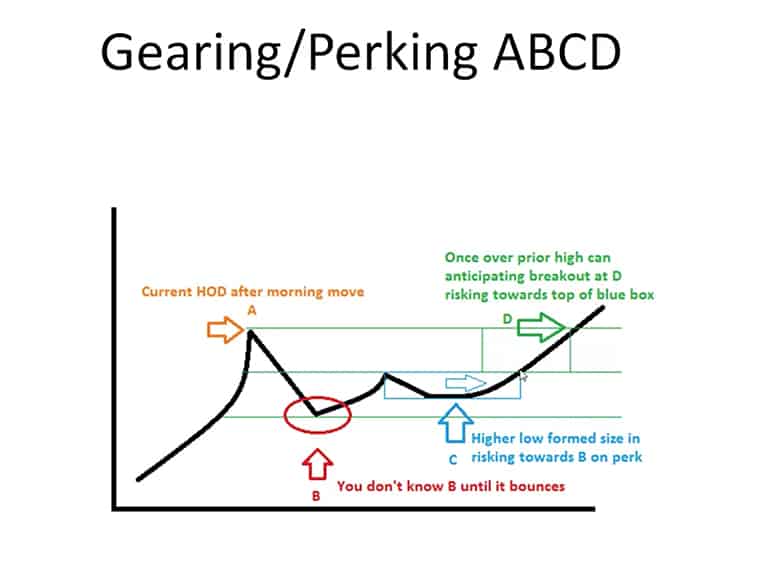

The stock runs up, reaches a level of equilibrium, comes back down and reaches another level of equilibrium. After that happens, the stock starts to perk a bit off its intraday low, which may foreshadow an upcoming breakout. You can also use the previous equilibrium level (support) as a set risk level. Here’s how this looks when using the ABCD pattern.

Multiple Time Frame Charts

Momentum trading is based around intra-day price action BUT we are still interested in “the bigger picture” of a stock. For this reason, you should be paying attention to stock charts across multiple time frames.

Looking at charts across multiple time frames helps you understand a stock’s back story. A certain price level may seem insignificant on a 5-minute chart, but may be a key price level on a 60-minute or daily chart. By focusing on charts across multiple time frames, you can better understand significant price points and plan your trades accordingly.

ABCD Chart Patterns

If you’ve been following Investors Underground for some time, you’re probably familiar with the ABCD chart pattern. This is one of the best chart patterns for new traders to focus on. If you are unfamiliar with the pattern, you can read our post on the ABCD pattern here or check out our free video guide here.

The reason this chart pattern works so well is because it is easily identifiable, it gives traders a set risk/reward, and there is very little “guesswork” relative to other patterns.

Point A represents an intraday high, usually set earlier in the day.

Point B represents an intraday support level, which we use to base our risk off of.

Point C represents the gearing/perking action we discussed above, a good place to start building a position.

Point D represents the break out, which we will eventually sell into.

Red/Green Moves

When a stock is “red” it means the price is lower than the previous day’s close, whereas when a stock is “green” it above the previous day’s close. As you could probably guess, when a stock goes from red to green, the price goes from below the previous day’s close to above the previous day’s close. This represents a shift in momentum that is often greeted with more buyers (meaning the price will increased at a faster rate).

Your goal should be to anticipate this “red to green” move. You can do this by looking for gearing/perking action and waiting for a stock to set higher intraday lows. Here’s how this looks on an intraday chart:

For over 8 more hours of lessons, check out the Textbook Trading DVD course.

Excellent blog post. Good job, Nate! Very helpful.

Very insightful, I learnt a lot. Thanks Nate!

Thanks so much Nate, as you know seeing me a few times in the iu community and plogging along here learning set up recognition, sizing my sizes good for me, learning from others.. i just can’t say how welcomed I feel that when I really really am ready to go at this level of focus , IU is there.. i’ve started back up on my blog where I left of in 2014 after coming at this full tilt.. then learning humility the not so hard way, with small losses, my efforts and focus are re upped, and i do hope as I carve out the time and attention to get disciplined, that I can be an example of what your mentor ship and courtesy really legitimately brings to all those are wanting to really improve.. thanks

Awesome and much appreciated👍🏼 Love the AWX and MTSL trade breakdown as well!! Thank you 🙏🏽

Thank you for this information. Still a noob, but learning everyday.

Great info. Thanks

Hello from india.Sir i m fan of u.i listen u r chat with traders episode.very helpful . appreciate ur work . dhanyawad