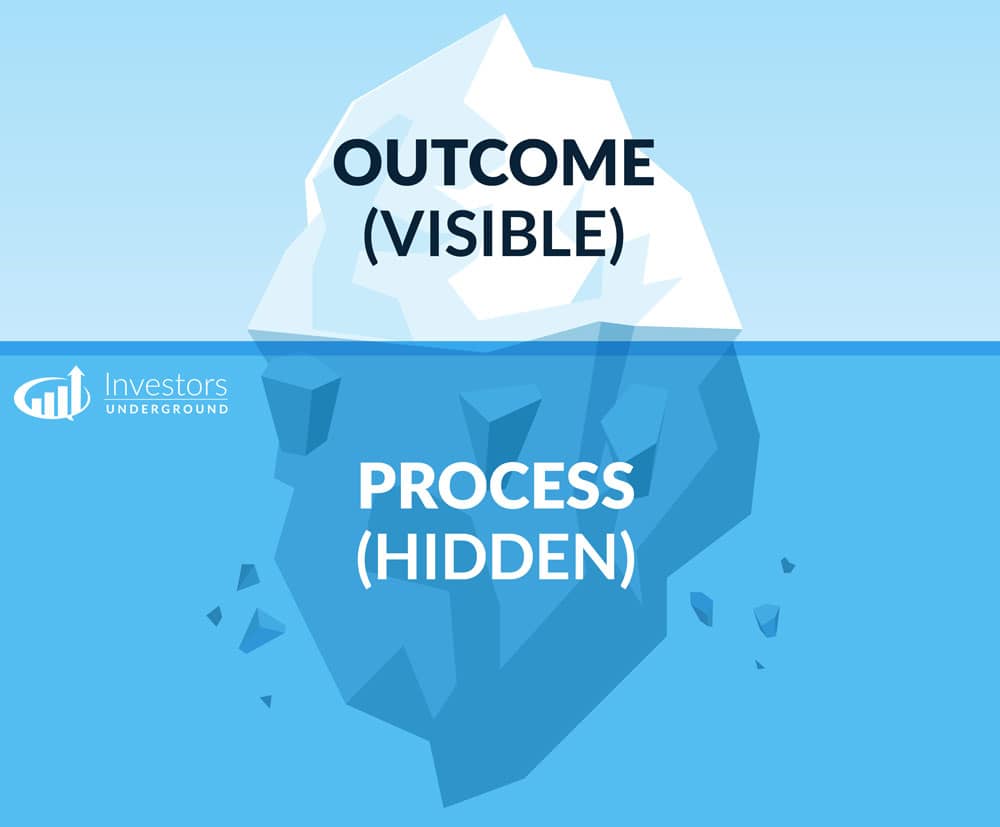

Success can seem like a mystical phenomenon to the untrained eye. The dichotomy of so-called “haves” and “have-nots” is mind-boggling to those who don’t understand the inner workings of achievement.

Cynics write success off as luck while high-performance individuals choose to study its nature.

If you spend some time studying successful entrepreneurs, athletes, intellectuals, and traders, you will realize that their success is anything but random. More often than not, success is the result of calculated processes. One of these core processes is routine.

The Power of Repetition and Structure

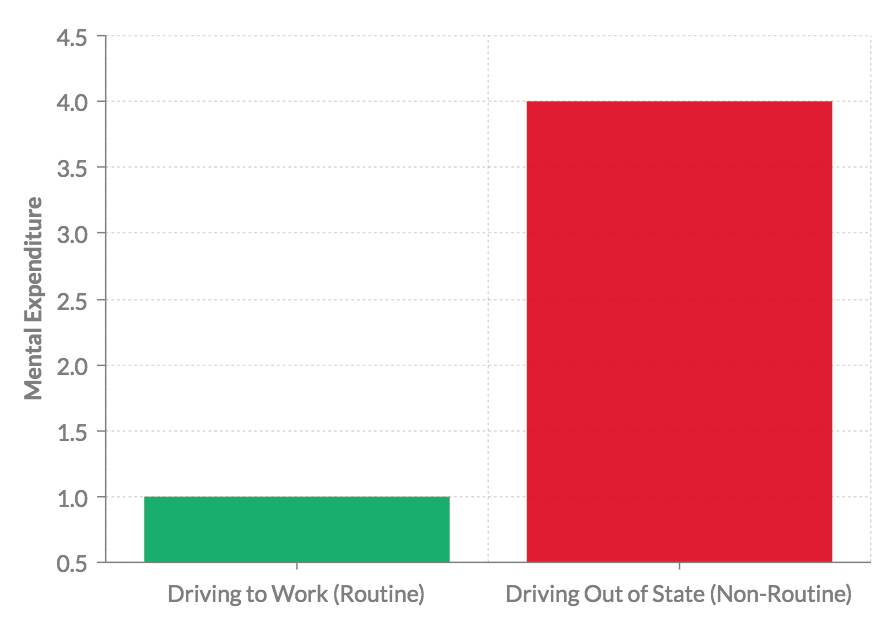

A routine is a series of purposeful, repeated behaviors. Over time, this repetition conduces automaticity, easing the mental expenditure required to complete daily tasks. For example, your morning routine comes as second nature. You wake up, hit the snooze button 1-15 times, brush your teeth, shower, get dressed, and deodorize all before drinking your morning cup of coffee. You don’t need a checklist or guidebook. You just do it – and you’re more productive because of it.

Routines make life easier and more robotic (in a good way). Studies have even shown that patients with severe memory loss can perform their routines on autopilot, despite their inability to understand how or why they are engaging in such behavior.

Routines simplify the process of performing the daily tasks that are vital to our well-being. Furthermore, routines add a component of structure to our lives. You don’t think about whether or not you’re going to brush your teeth in the morning – you just do it. You don’t check your calendar to schedule your nightly routine – you just do it..

Routine is often overlooked because it’s not as sexy as analyzing charts and studying strategy but it can be just as important (if not more). If you roll out of bed at 9:25AM and try to place trades from your phone on the way to work, you’re doomed before you even put your “strategy” to the test.

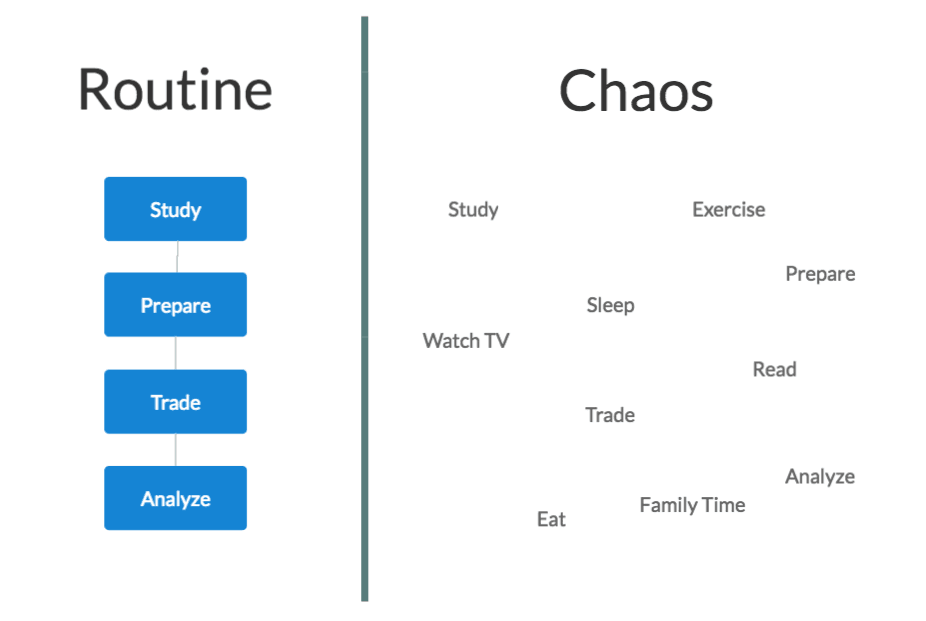

We’ve previously discussed the importance of eliminating noise and randomness from your trading strategy. Developing a routine helps you remove these same variables from your life.

If you think routine development falls under the category of fluffy lifestyle advice that is insignificant to your bottom line, think again.

The Importance of Routine

Some people pride themselves on their abilities to thrive under chaos. While this maverick mindset may sound cool, it’s not conducive to optimal performance and it’s rarely sustainable.

If your approach to trading is random and chaotic, your results will mirror your efforts. You may experience sporadic episodes that resemble success, but you won’t develop the habits necessary to sustain a long-term trading career.

Deliberate processes are crucial to functionality, sustainability, and scalability.

The proof is present in all case studies of success.

- Tom Brady is successful because he commits to a strict training program.

- Amazon is successful because of the company’s superior processes.

- McDonalds is successful due to the scalability of their processes.

There will always be outliers who defy this rule, but fortune favors the prepared. Why test your luck?

Having a routine is a fundamental component of lifestyle optimization and, therefore critical to your success as a trader.

What Makes a Good Routine?

There is no universal routine that is suited for every trader, but every routine shares a few common traits and benefits. Think about each of these points when you start to build your own routine.

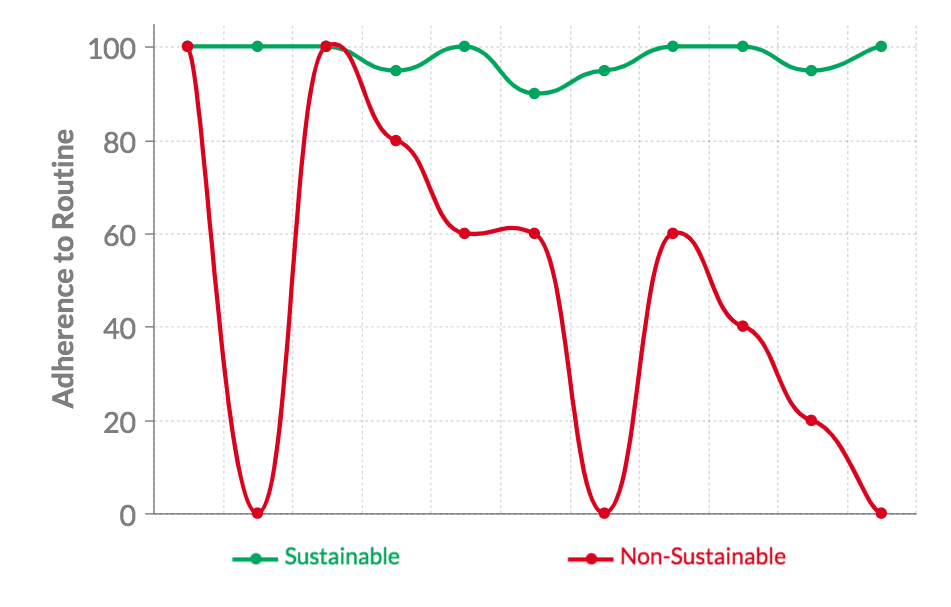

Is it sustainable?

First and foremost, a routine should be sustainable. If you can’t stick to your routine, it’s worthless. This is why the majority of people who go on a diet regain lost weight in future years. It turns out eating four apple slices and dry chicken every day is unsustainable.

The same logic applies to traders. You need to set realistic goals if you want to develop sustainable habits.

While it may be beneficial to wake up at 4AM or spend 8 hours a day studying the markets, it’s unlikely to be sustainable. Consequently, you are likely to break your routine and set a bad precedent that renders your routine worthless.

Is it goal oriented?

Your routine should be cleverly crafted to help you achieve your primary goals. In this case, the primary goal is improved trading performance, and everything you do should be focused on this goal. Breakfast with friends may give you a refreshing oxytocin boost, but does it improve your trading performance? You be the judge.

Does it improve my mental clarity?

Certain habits have an indirect impact on performance. These habits are designed to optimize the operator of success (i.e. the trader). For example, a basic morning routine won’t make you a better accountant but it will make you more productive which will lead to improved job performance. Similarly, for traders, a morning run won’t directly improve your trading skillset but it may provide you with the mental clarity you need to make better trading decisions.

Does it minimize mental load?

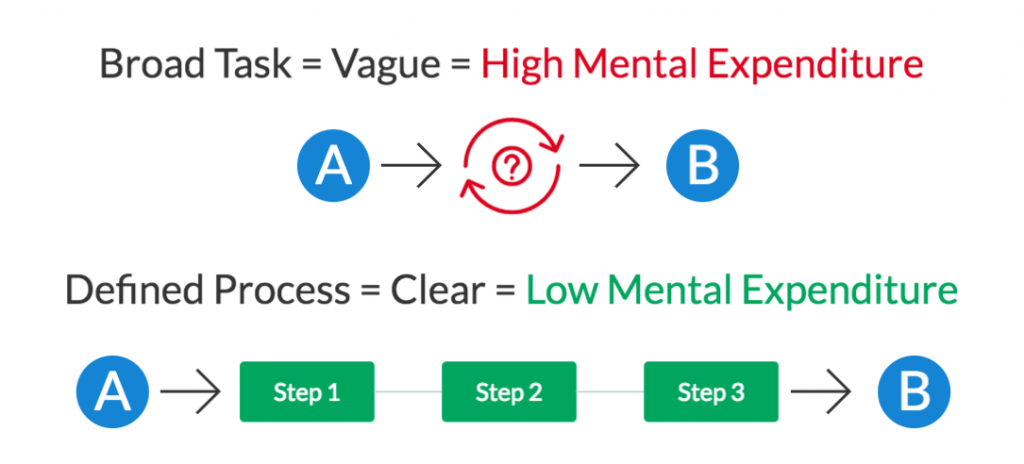

As mentioned in the introduction, a good routine can ease mental expenditure. By creating and following a series of repeatable steps, you begin to minimize the brain processing power required to make basic decisions.

Imagine if a McDonalds employee had to make a Big Mac from scratch. The error rate would be high enough to put the company out of business. Fortunately, the company has formal processes that allow even the most incompetent of teenagers to create one of the world’s most popular burgers.

Approach your trading the same way. Try to create routines and processes that ease decision making and decrease margins of error.

Is it specific?

It should go without saying that a routine should be specific and scheduled. Going to the gym everyday is a habit, but going to the gym every day at 7AM is a routine. Going to the gym at 7AM with a planned workout is an even better routine.

Simply put, a stringent routine is an effective routine.

How to Build Your Routine

Now that you know the components of a well-rounded routine, it’s time to start designing your own.

Routines are not one-size-fits-all. The best routine for YOU is the one that allows you to achieve optimal performance. Some traders wake up at 4AM and others wake up at 9AM; one isn’t necessarily better than the other. Feel free to experiment with your routine to see what works best for you.

Here are some things to consider when personalizing your routine.

Morning Routine

Morning is a time for preparation. You want to come to the market with a game plan AND a mindset that allows you to execute this game plan to the best of your ability. Here are a few things to consider:

Mindset/Performance

- How much time do you need to prepare?

- What time should you wake up? (and how much sleep do you need?)

- How do you achieve mental clarity?

- Do you need caffeine/food?

- What distractions will you face and how will you deal with them?

- Is there anything you can do the night before to make your morning routine easier?

Game Plan

- How do you refine your watch list?

- Do you review market news?

- Do you run pre-market scanners?

- Do you create a specific game plan?

Trading Routine

During market hours your goal should be to stay focused and manage your trades (or lack thereof). If you have an effective morning routine, a lot of the work will be done for you already.

- During which hours do you trade?

- What does your environment look like?

- How do you eliminate distractions?

- Do you take breaks to destress?

- What do you do when there are no trading opportunities?

Post-Market Routine

Post-market is a time to review your performance and plan for the next day. It’s also a great time to continue working on your education. Here are some great ways to use this time:

- Review your trades

- Scan for stocks

- Build a watch list

- Study (Charts, Courses, Lessons, etc)

Overall Wellbeing

Your overall well-being will play a role in your performance. If you’re like 99.99% of people, you’re not your best when you’re unhealthy, under-rested, and stressed. This isn’t a PSA; it’s a fact. Don’t discount the impact of healthy lifestyle choices, as they will inevitably creep into your trading.

Here are some considerations:

- Do you exercise regularly?

- Do you have a healthy diet?

- How many hours do you sleep every night?

- Do you take time to destress?

- Do you spend time on your passions outside of trading?

Take Action

Take some time to think about your trading routine. Look for areas of improvement and focus on designing a routine that is built for optimal performance. You don’t need to knock this out in one shot. It’s an ongoing process of learning which habits are most conducive to your success.

If you have any specific habits, routines, or processes that work well for you, share them in the comments so other traders can learn from your experience!

Nate,this is the second time recently I’ve got a blog post from you exactly when I needed it most. Thank you

Great post brother. Thank you for sharing your thoughts. I will work on a sound trading plan and a routine, and tuck it right into my full time employment.

Just when I needed it the most! Bless you Nate❤️

You know what is another Iceberg? IU, that is who.

What you say and do is only the tip. The effects you cause on the people that follow you is huge…

I can´t find the right analogy.

You guys are great. Super article and super choice of article.

Just an awesome article.

Great Write up Nate. Thanks for sharing.

Thank you, it is really helpful

Thank you for the sound advice. It has been very useful in my development.

Cardio is the boom. I swing trade as I don’t have the capital for day trading. For me the stop loss has to be obeyed.

I believe that it’s really very hard to stick with a particular trading routine. In the stock, there are always fluctuations, so all you have to be flexible if you want success.

adjusting to the market has little to do with good trading routines. Routines keep you on the road in the right direction. Wisdom and experience help you navigate the potholes. Apples and oranges.

Best of luck.

Great advice. When trading always trade with the trend and look for a “area of value” for your entry point.

This is a very good guidance especially for beginners in developing a good Trading Habit/Routine that every trader must have to achieve success in trading. Thanks for sharing.

Good solid helpful advice, taking care of the basics is essential for any endeavor.

Rutines are Key for trading succes. I spent a great deal working on it.

Here’s my rutine:

1. (6.30-7.00 AM EST) Wake Up, Bath, Drink Watter.

2. (7.00-8.30 AM) Meditate, Read Book.

3. (8.00-9.30 AM ) Meditate, Coffe, Prepare for Trading.

4. (9.30-11.30) Trade

5. (11.30-1.30 pm) Study Trading

6. (1.30-2.00 pm) Review Trades.

7. (2.00-3.30 pm) Gym, Eat.

8. (3.30-4.30 pm) Scann, prepare watchlist For tomorrow.

9. (4.30-6.00) Recap With Trading Buddie.

10. (6.00-9.30) Family/Friend Dinner.

11. (9.30-10.30 pm) Sleep.

Optimizaning my Rutine has boosted my performance exponentialy. Im grind 10hours per day and i comes automatic. Really recomend!

Any tips for how I can transform my routine into something similar to this? I have developed bad habits and am lazy a lot of time, trying to make a change..

Any tips on how to work on getting in a better routine? I’ve developed bad habits such as being lazy and waking up late and I’m struggling to get into a more productive routine and wake up early in the morning.

Newbie, I work an 8 to 1:30 job get home and trade from 2 to 4. Any recommendations on what routine might help. I study charts and make game plan on what stocks I might trade at night after done trading. Look at stocks on break so I have an idea what stocks to look at when I get home.