Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

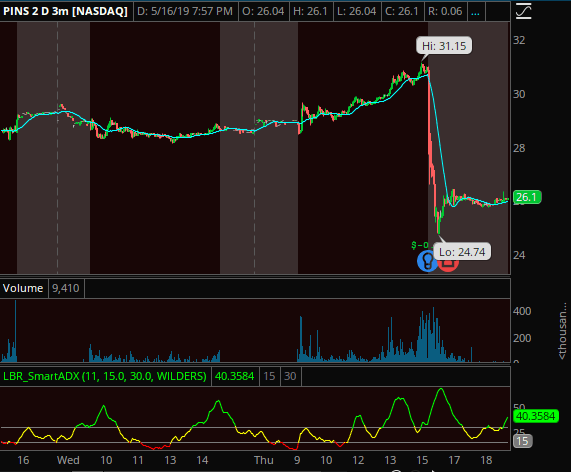

Haven’t been trading a ton of late as I’m focused on an outside venture for a few months, but today was awesome. Need to send PINS a fruit basket.

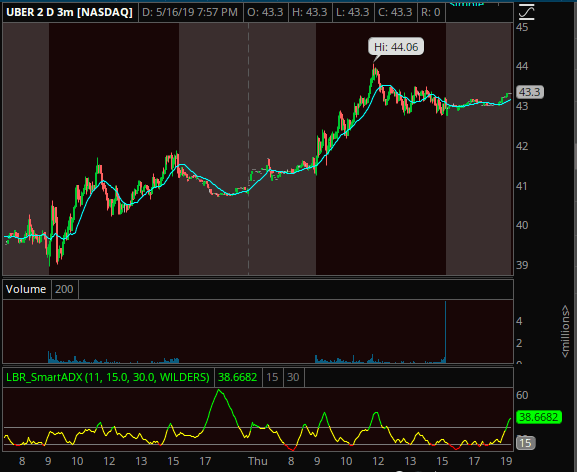

UBER: This thing was just a SPY puppet today, no actual buying interest just computers doing what computers do. So I still expect this to fade back, but pay attention to the SPY. If it’s not cooperating, don’t fight it. But if we get a little fade in the overall market tomorrow UBER probably gets wrecked with it which is the inevitable outcome eventually, and if I sense market weakness this will be the first name I go to when looking for a short.

PINS: I had a few I took at the end of the day and held into e/r, something I almost never do, but seemed like a decent idea if sized properly. The end of the day rally was likely just shorts covering and taking off risk into e/r, and the “strength” actually made me feel better about the play to hold a few into e/r. This is a company that went public that has completely stagnant growth and IPO’d to cash out before it was too late. This is an all too common scenario with Tech IPOs because Tech becomes obsolete and the next hot thing always replaces them. So this e/r report was nothing new in that story line. I’m hoping they can find a way to jam it up tomorrow morning back towards maybe 28-29 and then it should fade off again. Big per share loss & just in-line revs, nothing to be excited about at all.

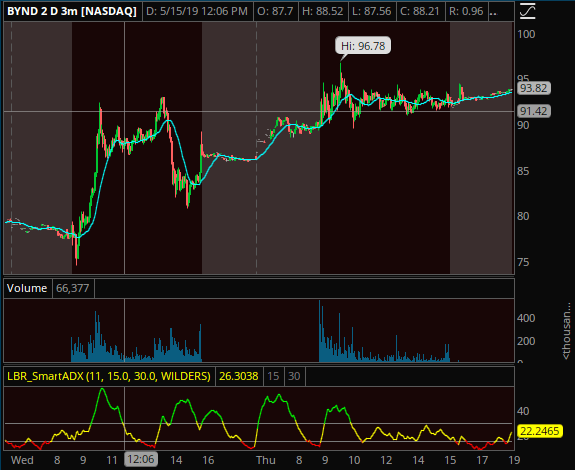

BYND: What an insane mover last few days, sick range & absolutely punishing shorts. The inevitable game here will end poorly, although I’m not sure it’s done yet. That massive consolidation day today is a little scary as a short prospect just yet. They either trapped a whole new round of victims or they’ve been positioning against 94 and this shits the bed tomorrow. Either way, to be safe I wouldn’t try the short until 90 peaks out if there’s a weak open. I’d be much more excited to see it gap up & rip early tomorrow and maybe give a 100 handle, then die shortly after.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments