Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

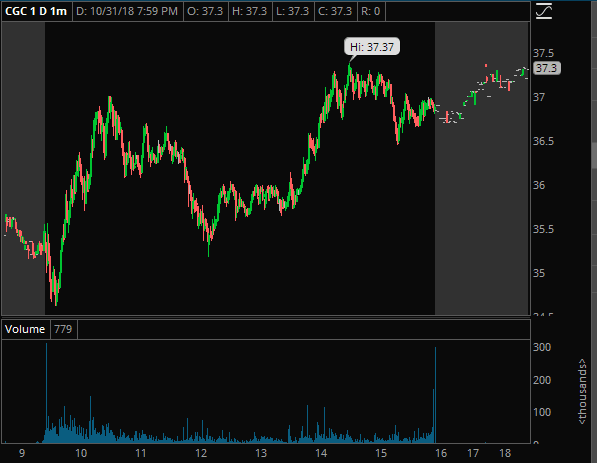

CGC: This has been a nice play the last two days off the 32 o/u long idea. Congrats to anyone who took it. We’ve up trended with dips the last two days, so I’m monitoring the market tmrw for this to change and looking short. Ideally morning strength into the 38s and then reject from there and short failed follow thru pops. Nothing I’m looking to find the top on, but could be a decent play.

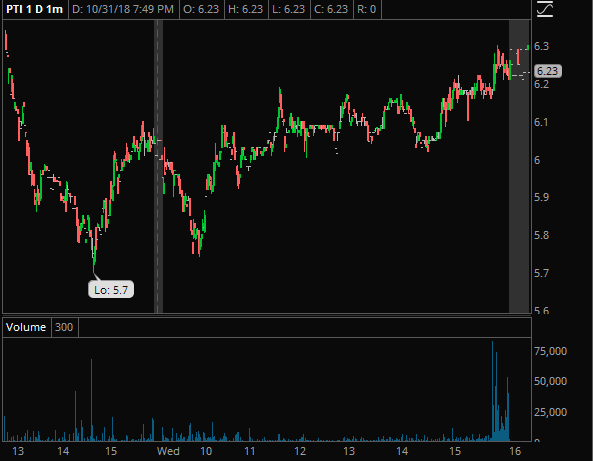

PTI: Don’t want to lose this off radar. It’s a total pig. Some grind today which is nice, I’d like to see it fail into 6.50 tmrw and then fail & lower for the swing short idea.

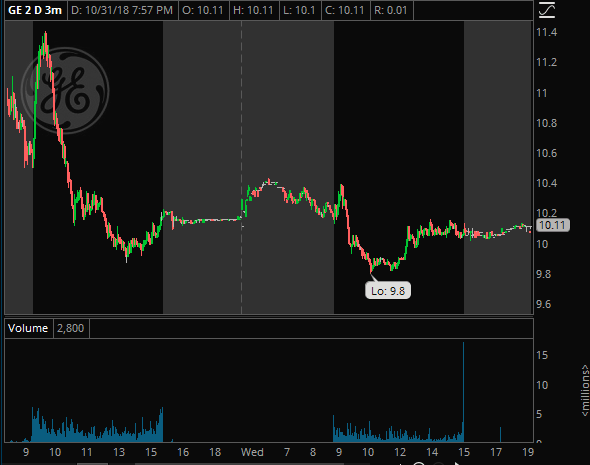

GE: I think the worst is over. It really can’t get much worse. The negative news is out. The dividend cut is a big issue, but it’s here now, and the fact it couldn’t get much below 10s says most people who wanted to sell are probably out by now. I continue to think this company is a good long term long investment. They are not going anywhere anytime soon, they have been through the ringer over the past 12 months, and I really do believe the worst is here, and better days are ahead for GE. Congrats all shorts who continued to believe the dividend was an issue, you were right, and you’ve been paid handsomely, but I wouldn’t get greedy anymore at these levels now. Keep an eye on it to hold higher lows and look to join dips long would be my idea. Swing if you can.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments