Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

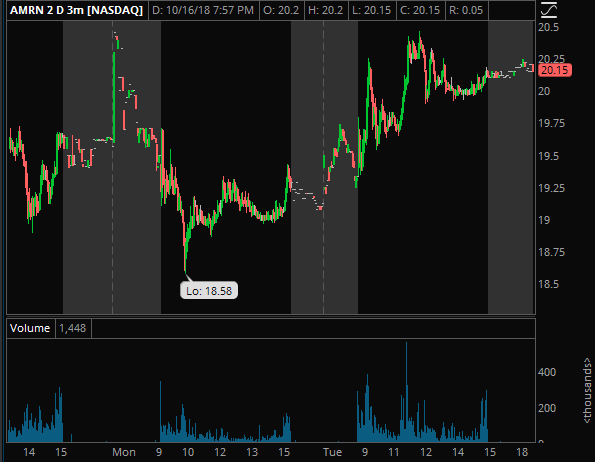

AMRN: Nothing changes here from previous plan. This will be on watch every day for a while. Baker Bros are up a few points right now but I highly doubt they got in the name for 3 bucks. Nice churn on 20 this afternoon, I’d love to see that 19.75-20 area become a new support base and hold on a weak open tmrw. That should be the green light into the mid 20s if that’s the case. I’ll be watching.

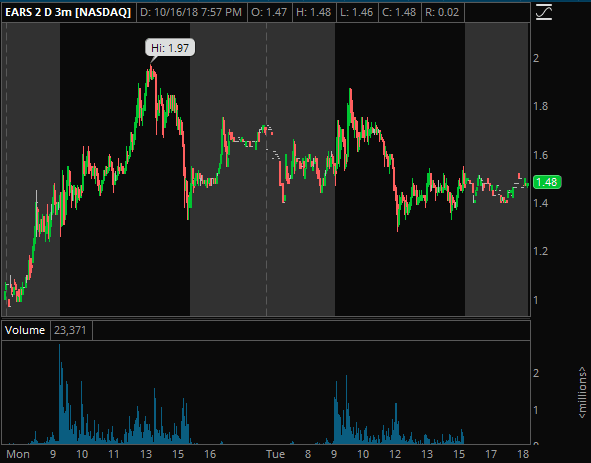

EARS: Perennial shitbag alert for sure. 1.40 the clear spot here for me. If weak open, I won’t chase into 1.30s-40, I’d need to see that peak out first, and then still plenty of meat left down to sub 1 where it’s inevitably heading in the not too distant future. The momo seems to largely be gone and most will rotate into VTVT and whatever else we wake up to tomorrow I’d imagine, so have this on watch for a potential short play. We have the weed catalysts tmrw as well. But here on EARS, ideally open shove into 1.70s and failed follow thru, attacking pops from there.

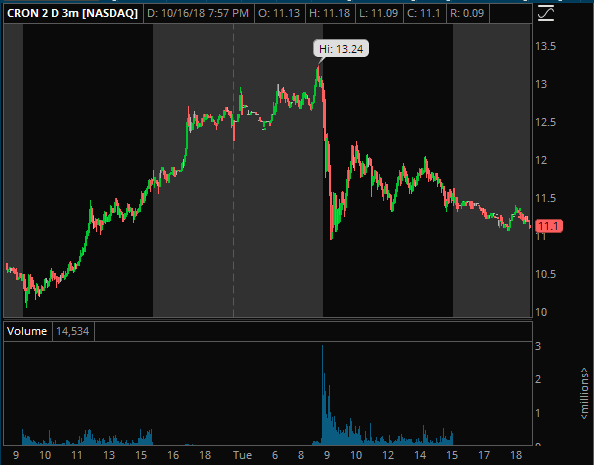

CRON/CGC/TLRY/NBEV: Seems super obvious “sell the news” day for the weeds tmrw, so I have a suspicion they’ll probably be longs. I don’t know. Honestly these just annoy the living hell out of me still, and quite frankly, they’re just hard trades. Likely won’t touch any of them, but if I was going to, I’d be looking for weak opens to hold and catch a long, simply on a contrarian thesis. Everyone is looking short so it probably doesn’t work all that well tomorrow. I wear a tin foil hat sometimes, and probably am here, but I think they had them all be super weak today to give shorts some confirmation bias for tomorrow and try to get them all doing the “add add add” thing if they catch bids.

At the same time, I could see them getting obliterated, which they deserve to. I know that commentary isn’t much help, but that’s sort of the point. Don’t think anyone really knows. 6 months out from now they’ll all be 50%+ lower, but that doesn’t do you much good for tomorrow. Stick to reactive scalps and no fighting if you must play them.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

Thanks

Thanks as always Dante.