Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

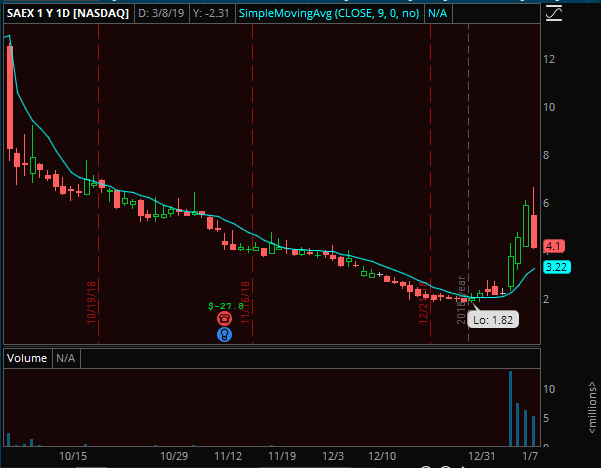

SAEX: Today was the “money shot” into close…a little late but this is exactly what we expected from literally one of the shittiest publicly traded companies to ever do it. I’m hoping for another opp, a jam into 5 tomorrow would be nice for re short entries, and the ultimate resting place for this name is right back where it came from in the 2s, so if you’ve got some patience, some BP and some time, this is a very high probability swing ss for a while now that it’s broken, still some decent meat on the bone bigger picture.

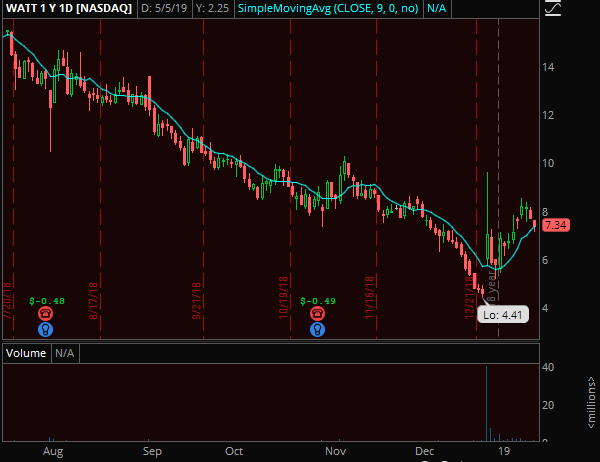

WATT: Been short this name for a few days now from low 8s. It’s basically dead. CES is over, they have no catalyst to even play off now. If anything, I could see maybe one more bullshit PR attempt to jam it and announce an offering, which is coming one way or another. This is one of the highest tier Perennial Shitbags, it will go into the Perennial Shitbag Hall of Fame when all is said and done, and they’re just doing what they can to milk it in the process. I like this also as a short swing idea with a mid 8s stop, but I don’t think we see those levels again personally, and end up much lower in a couple weeks or sooner.

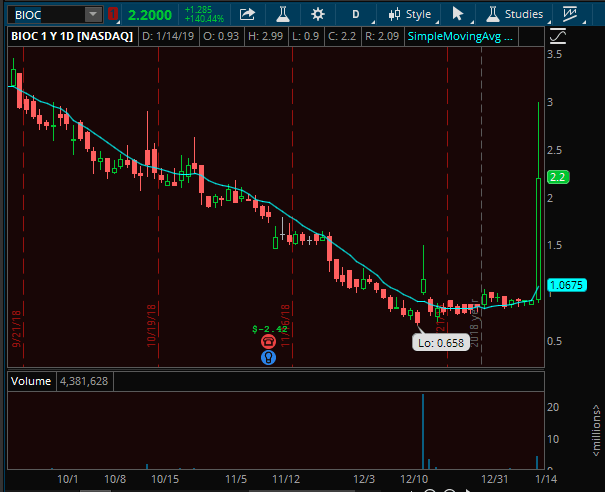

BIOC: Pleasant surprise today, another known turd runner that won’t keep these gains. I’m hopeful they get early shorts stuck tomorrow and give one good shove back 3+, but that may be wishful thinking. Regardless, this is on watch, but only if there’s more fireworks tmrw. If it opens weak or anything of the sort, it’ll be a total ignore or me and on to the next.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments