Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

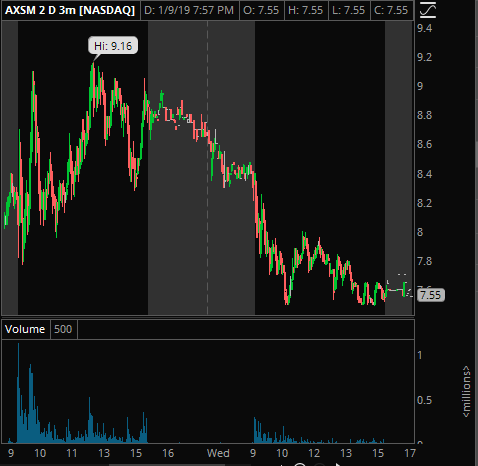

AXSM: Really surprised by the action today, wasn’t expecting a weak fade into SSR and continued selling pressure, but here we are. I have a feeling it’s a long tmrw, just based on the lack of volume present today compared to what had come in in the past days. Weak open and reclaim of the 7.50s ideally for the short-term long idea. Bigger picture I don’t believe in this name at all and expect 5-6s by next week. If it doesn’t recover by mid morning tomorrow, I’d bail on that long idea completely and look to hit pops short.

ZN: You’ve got to be kidding me. You’ve got. To. Be. Kidding. Me. When will this horrible nightmare end for good. They’re all going to need to pray to their God out there to atone for the horrible misleading game they’ve played with investors for far too long. It needs to end, it just gives me a headache at this point.

This is another name I probably won’t go near, simply because of the price, I just don’t trade this stuff, but this is the dictionary definition of a bullshit PR, and a Zero company that’s delaying the inevitable. Look to fade this tomorrow on any pops of strength. On second thought, I might actually short this, just based on how incredibly stupid this is and I’ve never been more sure of total nonsense in my life. Z-e-r-o. If that wasn’t clear 🙂

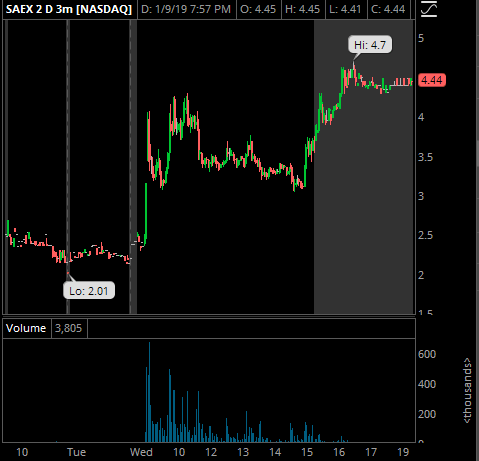

SAEX: What’s this…the 30th time they’ve ran this thing? I’m amazed they still find chasers for this, but is what it is. I love seeing it, congrats to all savvy longs banking on this understanding it’s just a trade, and I look forward to tomorrow and Friday, this should bite the dust in a big way as it’s no secret that it’s a total pile of doggy doo doo. That said, it doesn’t mean short and add at will, you still have to respect the action, but I’m not expecting it to get much past 5 and it’s got my attention in a big way around that level, watching for sellers to step in. Ideal short entry low 5s-5.50 area. with a 6 stop.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments