Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

Curious what it’s like to be a member at Investors Underground? Here’s a tour around the community.

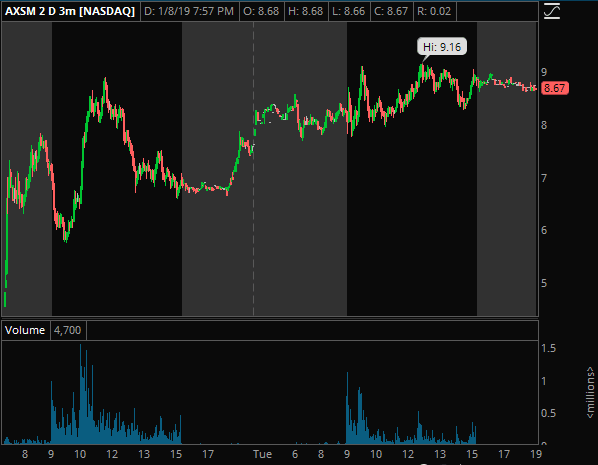

AXSM: What an attention whore, watched this all day. Never got long but also had the discipline to know not to short, never got a signal. It’s one of those names where you should just know by default not to size too soon or fight based on how thin it gets when they want it to be. Really never any blow-off today, I thought it was gonna go a few times there. Wondering if they weren’t waiting for T+2 and they do something stupid with it tomorrow. That’s what I’m hoping for, maybe a weak open into 8, trap, face rip on volume into 9s and give them something to start unloading into would be ideal. Regardless, I can’t see this just fading off into the sunset peacefully at this point.

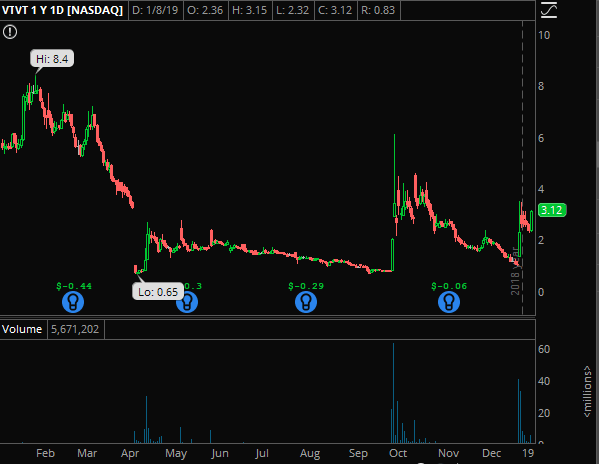

VTVT: Glad this is back, always a fan favorite on the Perennial Shitbag Channel. Looking at the daily, ideal scenario would be a morning rush into mid/high 3s and look to get short there once it peaks out with a low 4s stop.

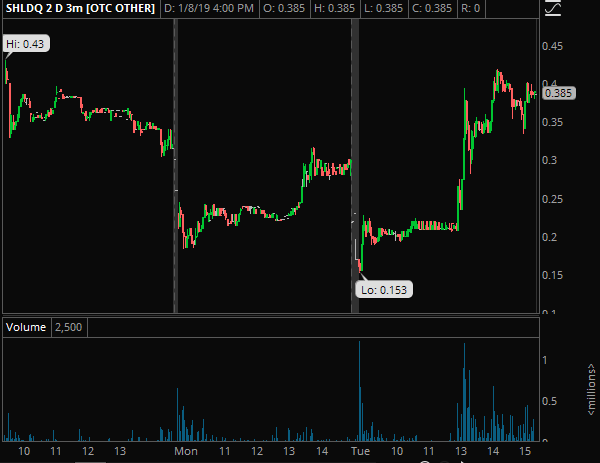

SHLDQ: Not personally my cup of tea, but will mention for those that trade OTCs and sub pennies. The PR that they may have a way out of bankruptcy is L O L, they have no shot of saving this sinking disaster, that’s all noise and delaying the inevitable. That being said, hell of a 100%+ move off the lows today, and this now likely provides a good short swing opportunity here with some meat on the bone should you trade this kind of stuff. I wouldn’t dive in head first just yet as this is still sort of a headline risk for a few more days while this bid nonsense plays out, but keep it on your radar, once that passes it’s straight back to reality for them. Sears is not coming back any time soon. Their days were, are, and will continue to be, numbered.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments