Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

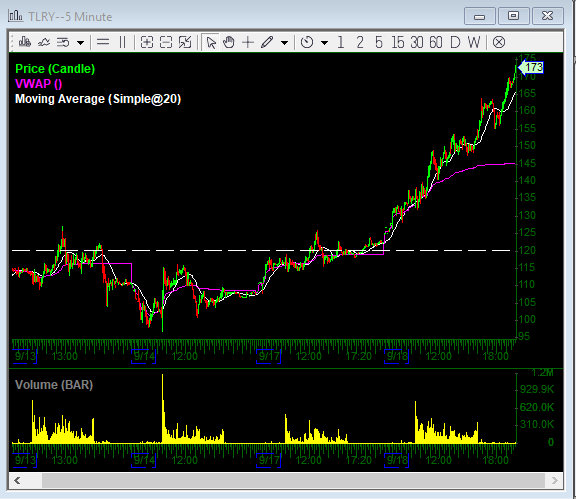

TLRY: Ok…this gap right now is just insane so far. I’m really, really hoping it’s even bigger when we wake up in the morning, and we get a morning rush on 190-200, that would be the ideal scenario for a short trade. I don’t even want to mention the word short on this thing obviously, and if you are a newer guy I strongly, strongly suggest you don’t go anywhere near it. But if there’s ever a scenario to look for the short trade, the huge gap & CNBC exposure would be it. So we’ll see what we wake up to tomorrow, if it’s a morning jam & rush towards 190s, I’ll be looking for the short assuming can find a borrow. Very, very cautiously with small size. And if you get a few bucks quick, take it. Would treat this same as the others CRON and CGC, if you are looking short, these are just scalps for now until a few day trend reversal establishes itself.

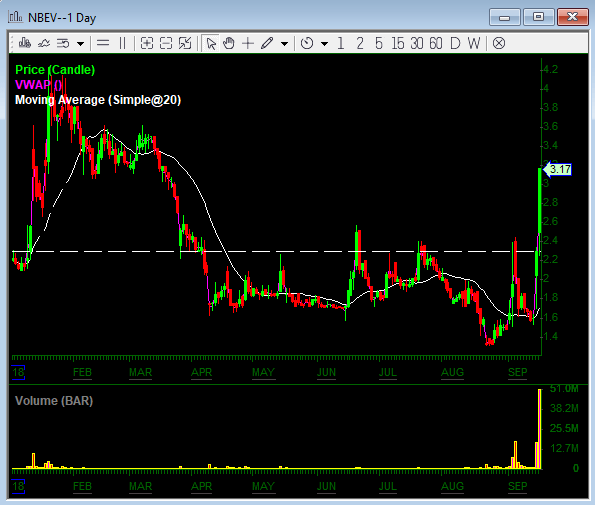

NBEV: They successfully baited this into a wicked trap and got everyone…again. I don’t really want any part of this short anymore right now after seeing the massive volume and trappy action today, these guys are absolute pros with the quick sharp yanks to draw in new short blood time and time again. Plus the prospect that this is tied to TLRY as one of their main investors, there’s a good chance they run this more in my opinion. Honestly hoping for a weak open hold and maybe a long off a defined risk, we’ll see what it looks like in the am. Wouldn’t chase it higher if strong open, only a weak open hold for the long idea.

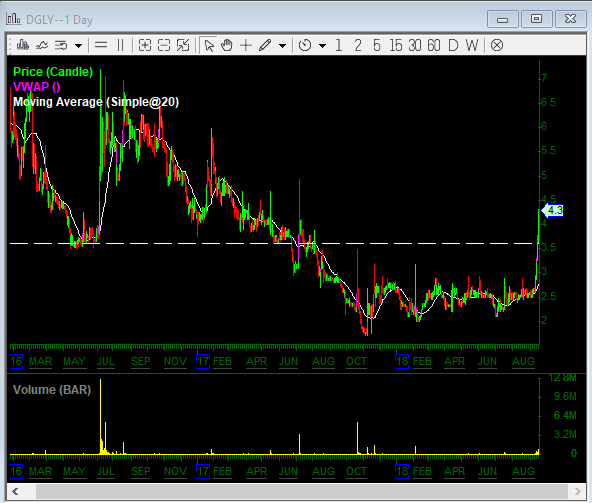

DGLY: Perennial shitbag here, nice move off 2.50s so far, wish there was a little more volume, hoping we get that tomorrow and would look to start into the short around 5. Will ignore if we don’t get that vol though. Shorting into low volume grind is almost always a bad idea.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments