Check out my audio-blog series, where I narrate all my favorite blog posts for you guys. You can find that here.

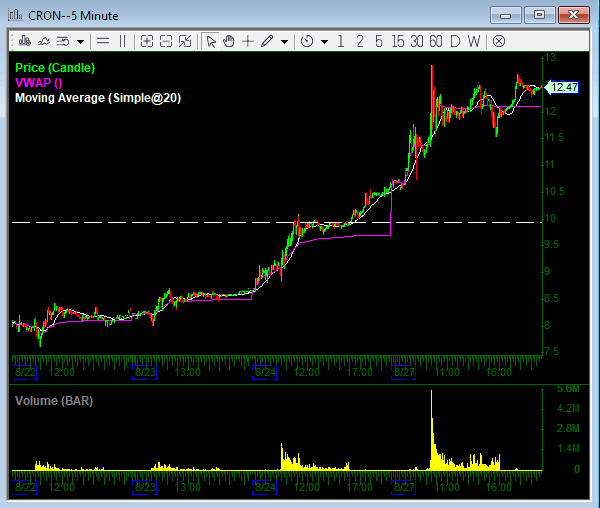

CRON: With CGC/TLRY, these weeds are just…wow. Memorized watching today, CRON in particular. First of all I don’t think the float is anywhere near 150M, the actual trading float that is. Incredible how the heavy the vol is, doesn’t seem that way on the tape though, and there is almost never size on either side of the spread and both of them move out of the way with ease when they want it to go. Translation? This is just a hard, hard trade after the open. The open trade has been consistent and I’d continue to look for that – which is to fade whatever is happening out of the gate. Gap up/open rips have been money shorts, and all weak opens have been great dip buy longs. I’d like to think this is getting a little out of hand up here with a market cap in excess of 2 billion now, but hey, here we are. So doing my best to keep the “unbiased bias” here, and just look to fade the open action, then reassess 10:30-11am+ for a secondary trade, but that one hasn’t been easy.

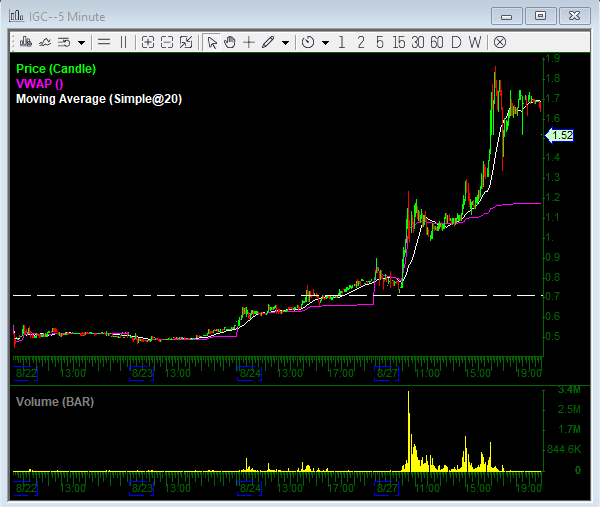

IGC: Awesome staying power and afternoon strength today. It looked to me like people blowing up into close there. Well not blowing up, but you know what I mean. Shorts leaving the trade. I like it a lot into the 2 area, this is a total perennial shitbag, I shouldn’t have to explain why, any stock coming from .40c explains itself, but do your own due diligence on it anyway. Fully expect this to melt down in a day or two – I’m a short into 2 area, hopefully we see that again tomorrow. If weak open, although not my cup of tea it’s probably worth the chase down if you’re cool with the swing idea. Should pay.

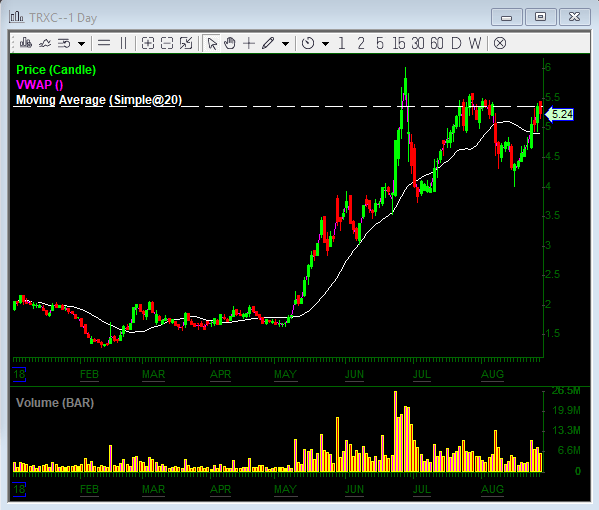

TRXC: The ole 5.50 fail – never fails. Again this can’t get over 5.50 today for about the 10th time, I will short it every time it gets anywhere near there until it stops working. Again remember this is, for all intents and purposes, a cult stock now – their tech sucks and it’s not growing, Najarian very irresponsibly pumped this on CNBC a couple days ago to give it the most recent push back. He’s an ass for that, but whatever. Will just add more bag holders to the backside. Not the best choice for a day trade here, but I continue to like the swing idea off 5.50 fails with a 6 o/u stop.

Shoot me a message anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss your trade ideas with you. If you’re not an IU member and would like to become one, you can join us here.

See you out there!

– D

0 Comments