You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a Tax-Back sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

Guest Watch-list from TWB52:

“The mkt is going to zero. Buy canned dog food, and short SPY.”

..so, yeah. That’ll be all from TWB52 tonight.

Now onto mine.

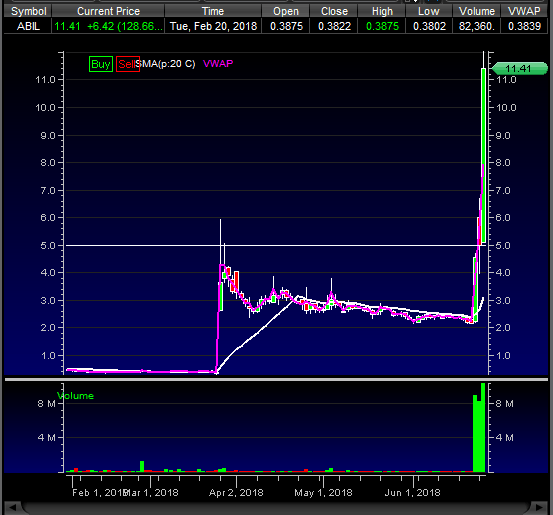

ABIL: I don’t really know what this is, but I feel like I should include it as people will be trading it tmrw. I’d trade this the same as all the other crazy momo low floaters. Caring about nothing but the current price action in front of you, forget fundamentals, not that there are really any to even DD on this. The rules I’d have for these is 1) Don’t hold them o/n, and 2) Trade the opposite of what’s going on in the morning. As in if there’s a weak open out of the gate, I wouldn’t look to be shorting, I’d probably try the long washout first, the morning moves usually have tons of head fakes. On the contrary if it opens strong and rips right out of the gate, I’d be selling into that if I was long, or fading the move and getting short. If newer, probably best to avoid the first half hour on these regardless, and wait for a trend to form and a consolidation zone where you can create a concrete plan and risk area to go off of.

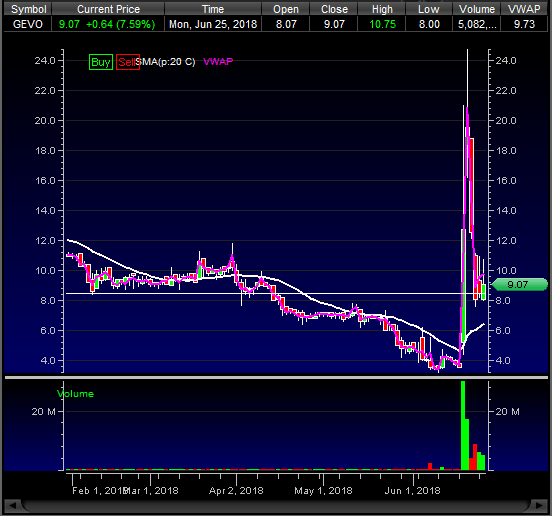

GEVO: Nice afternoon fail today, I like it ss on pops back into 10s with an 11 guide, should that set up.

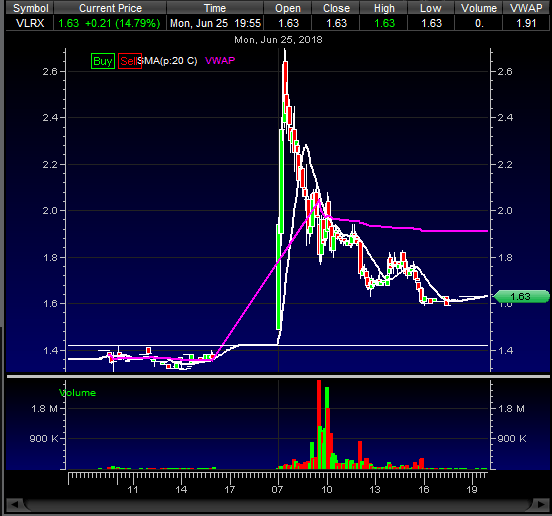

VLRX: They’ve turned this thing into a dilution machine. Nutso vol today strictly to sell into. I’m not anticipating we get much of a pop here, but if it got back over 2 I’d be interested in the re-short with a 2.50 o/u guide

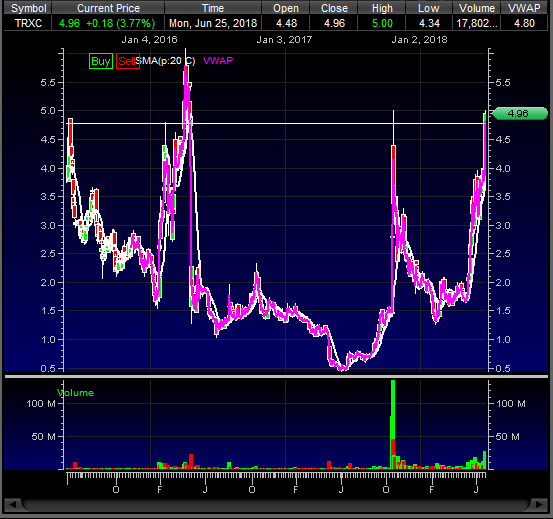

TRXC: Sitting at a very key level here into 5s resistance. I suspect it’ll jam up somewhere in the middle of that tomorrow, and I’ll be watching for some heavy selling vol to come in and stuffing action up there. If we don’t get that and it sort of just hangs around over 5, I think turns into a total avoid on short side near term, as they’ve brought some serious vol to this name the past few weeks and it can probably go a lot further than we think, especially if it consolidates over 5 for a few days.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments