You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a Tax-Back sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

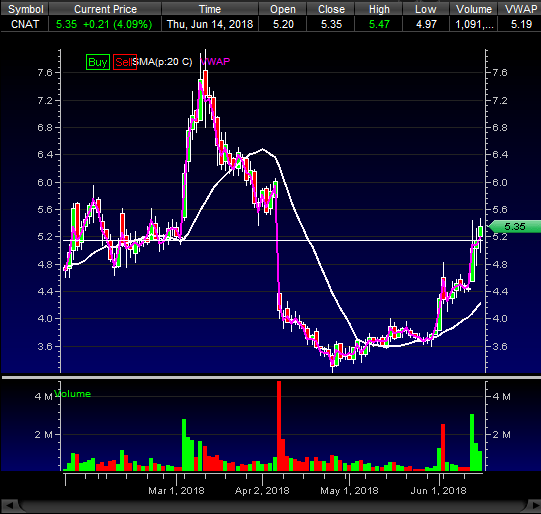

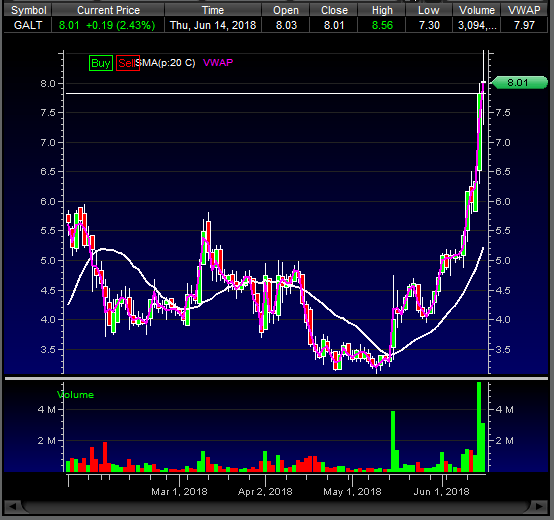

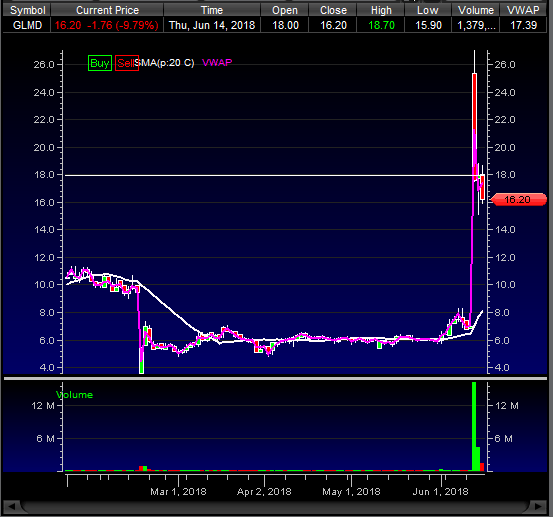

NASH “me too” names – expecting these to fizzle out soon, they’ve had their fun. CNAT. GALT. GLMD. All same thesis. None of these are deserving of the current run ups, simply an excuse to ride the VKTX/MDGL coat tails. That said, I really like VKTX, their drug mechanism is essentially identical to MDGL’s, and they should be updating p2 data soon, that’s likely the reason you’re seeing the run up & continuation, and the recent MDGL buyout rumors have only further fueled the runs. The other 3 perennial shitbags mentioned above though – they shouldn’t have a pot to piss in when the dust settles.

Don’t just rush in with the “it’s trash” Rambo mentality however. Yes they are trash, but you still need to wait for the technicals to agree. Nothing to find the tops of in this market re: CNAT/GALT, but they should be on close watch for downside breaks, I think they will all be good shorts in the not too distant future.

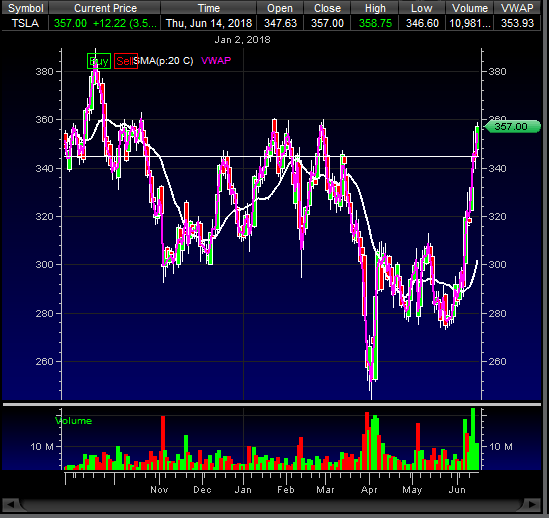

TSLA: Here’s what’s happening in my opinion. Obviously, it’s a massive short squeeze. But I don’t think the timing is random. Elon is probably full of shit regarding all his lofty promises like he’s always been in the past, but he doesn’t have to face that music yet for a few more weeks re: Model 3 5K/week production call, and a few more months re: Tesla going cash flow positive in Q3/4. So that leaves us with this little time window we’re in right now – to establish fear in shorts, which he did with Model 3/Cashflow positive calls, and then to absolutely rip the faces off of everyone who’s short. Think about it like “The Last Stand.” It also creates an exit opportunity when the shit hits the fan in the latter half of the year and he can’t deliver on his promises. Also towards the end of this year, some electric car competition is set to hit the market from other automakers, so that’s a negative for them as well moving forward. So the timing to do this insanity squeeze now, seems to make complete sense. It’s the best window they’ll ever have. So I believe TSLA is set to blow through 360 and potentially even ATHs and create one giant beautiful disaster before some real turbulence and downside follow. Just because it’s stupid and probably complete nonsense doesn’t mean you should be short. Timing is everything.

Right now the trade for me here has been to long dips, and I’ll continue to do that until it stops working. It’s not often you see a $300 stock with 39 million shares short, it’s quite a unique scenario and one of Wall Streets most bizarre battles. Will be fun if 360 goes tomorrow.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

0 Comments