You can find a compilation of all Alex and I’s webinars here.

If you’d like to get involved in the community, there’s a Tax-Back sale still going on here.

Also if you haven’t seen yet – I’ve started an Audio-Blog series. I narrate all my favorite blog posts for you guys. You can find that here.

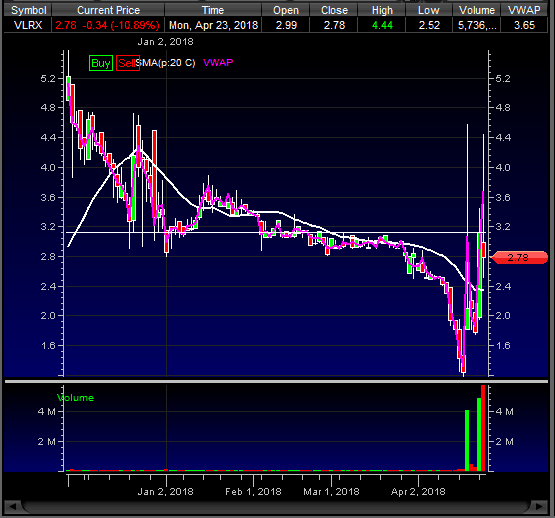

VLRX: No borrows – absolutely the tragedy of the day. I can say with almost certainty they’ll be offering soon, I thought it was coming a/h today but nothing, so maybe tomorrow am, or tomorrow a/h. But it’s coming. If it pops or runs at all and you have shares, I think it’s a great r/r short idea at any level up here around 3 into the inevitable offering looming.

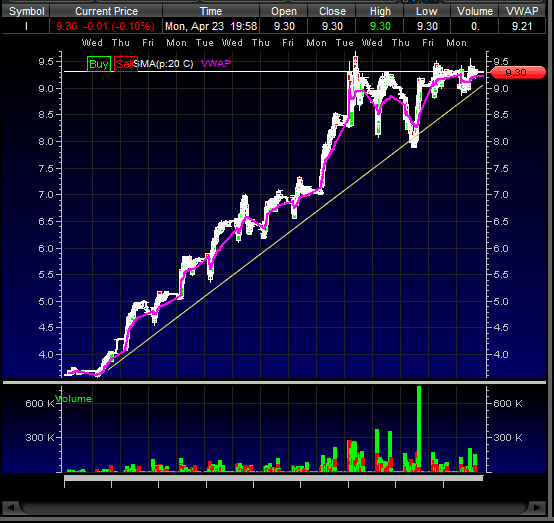

I: Continue to monitor this name, but don’t jump the gun and be over anxious on the short. Its been on an insane run and obviously tempting to short it, but often when something is so obvious, guess what? You’re not the only genius with the short idea lol, so it crowds up, MMs know the situation, they absorb the bid like they did at 9 today, and you get a squeeze situation. So this may continue to play games, you have to take it day by day and see how it’s trading, but I wouldn’t be surprised to see a 10+ blowoff soon before the real short play. Here’s a 14 day chart – I wouldn’t really look to short it until it clearly broke that trend line & put in a higher low or two.

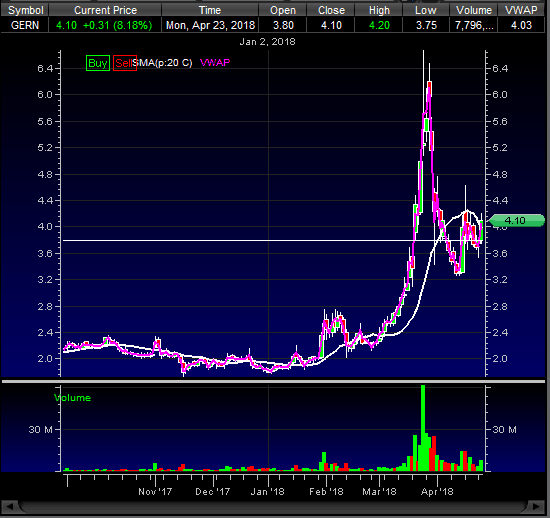

GERN: Crawling back here last two days, maybe one more shove day tomorrow back to mid 4s and if we fail to get above last weeks highs at roughly 4.60, I’ll be looking to short this back down on any failed follow thru underneath that. Would really like that shove though, if it opens weak tmrw, I’ll prob ignore it and move on.

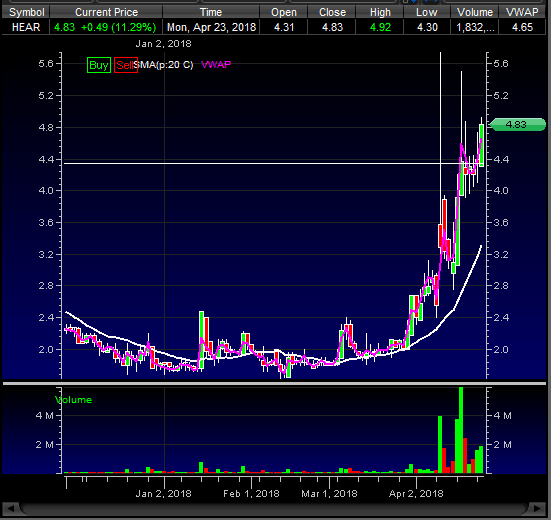

HEAR: Pesky, won’t go away. If we have some morning momo and a shove, I will feel obligated to try it ss into 5.50 area based on the past rejections, but nothing to fight with. It’s ideally a trade I’d get involved with around 5.30-40 with small size & be patient/give it room to 6 and look to add to a winner, not fix a loser.

If you’re not an IU member and would like to become one, there’s still a sale going on here. Shoot me a PM anytime in chat (DGTrading101 is my IU handle) and I’m happy to discuss trade ideas with you.

See you out there!

– D

Thanks a lot Dante