Hope everyone had a solid trading day! MTSL was yet another one of those “soak the float and let it rip” style plays we’ve seen lately. This time the float was even tighter than the last. The difference here is MTSL was much harder to borrow which can lead shorts to be more aggressive …. Huh? Why?

Most shorts, including myself, feel much better when the entire world doesn’t have access to borrows. It makes you think about entries a bit more and gives you a bit more confidence knowing that all of the retail traders do not have access to borrows. Take BBOX for example, which has been super easy to borrow every day. This stock attracted a lot of traders who “short because its up” and eventually let the “smart” money fade the action over the last few days.

So, with that said, if I was looking to short MTSL, I’d feel more confident that it had LESS of those types of traders in it. But, here we are ending up at the same place. Heck, we just saw it happen on GBR and STAF the past two days as shorts got RAN over. Sure, most won’t admit it — but they did. The way they came down after is the tell. A natural momentum move takes a lot longer to unwind. A pure short squeeze comes apart lke these two did the last two days.

One of the biggest things about our community is it’s not about following the leader. It’s about actually understanding the WHY behind the trades.

What made me take the trade? What am I looking for? What did I see? How can you learn etc.

There is ZERO value buying because Joe Schmo Banksalot said to jump and you jumped too. Trading is about becoming the BEST YOU that YOU CAN BE. Focus on self-sufficiency. Trading is about growing and adding tools under your belt. This is what we focus on. You’ll see as these momentum trades happen it’s time to ZOOM in on the level two action. YOU CAN’T TEACH LEVEL TWO !! So many ask – “Hey I saw this or that on Level 2 is that why you bought?

Answer: Partially but not really.

It’s such a subjective feel – there is no right or wrong answer. But the ONE WAY TO LEARN IS EXPERIENCE. How? Watch it — focus in on the key areas of break out / break down. Focus in on the key areas of soaking / stuffing. We just did a webinar on this exact topic last week.

Here’s the MTSL trade plan.

MTSL Trade Plan

I traded it a few times today — nice nail off the first move after I saw the soak. I took a couple other trades making sure that I downsized into strength while carrying a core position through the day. I added some into the close and also took a swing right before noon in the IRA with a big picture plan. We’ll see what happens I truly hope this blog helps with understanding the WHY!

MTSL Real-Time Analysis Video

Investors Underground Chat Logs

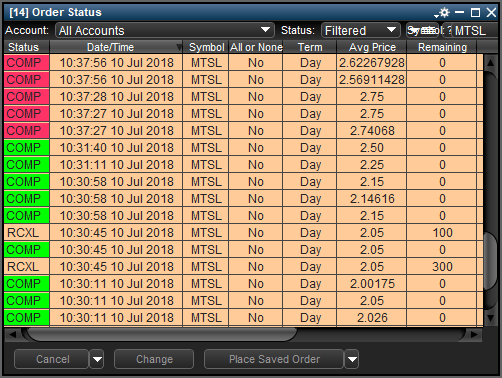

10:19:58 am InvestorsLive: MTSL action

10:20:07 am InvestorsLive: I knew she’d come back one day lol

10:20:13 am InvestorsLive: into halt

10:30:16 am InvestorsLive: 2 huge soak again MTSL

10:30:42 am InvestorsLive: if they reclaim $2.05 + and trend it you know they want to play ball

10:30:50 am InvestorsLive: Trading that game plan too thin for me to alert

10:30:54 am InvestorsLive: $1.80s for risk off dips

10:31:21 am InvestorsLive: Hope you guys are watching this level 2 action with commentary

10:31:33 am InvestorsLive: this is how you learn level 2

10:32:29 am InvestorsLive: 🙂 🙂 🙂 🙂

10:32:31 am InvestorsLive: !!!!!!!!!

10:32:31 am spositoalex: insane lvl 2 action

10:32:34 am InvestorsLive: it told the story

10:32:46 am AlexP: Great commentary Nate

10:32:54 am AlexP: So clear on level 2

10:36:48 am Volatility halted MTSL set to resume in 30 seconds (10:37:18 EST)

10:37:45 am InvestorsLive: had to sell 1/2 b/c chat room came in w/ adds – its just my rules

10:37:49 am InvestorsLive: I don’t want to but I had to

10:41:19 am InvestorsLive: Trading first wash on MTSL and then leaving it alone if they don’t support it

10:44:15 am InvestorsLive: MTSL :up

10:44:19 am InvestorsLive: lock in along way !! nice nail

10:45:03 am InvestorsLive: locked some around the core

10:45:28 am InvestorsLive: FIFO on this — bot the wash and newsletters come in long at 2.70-2.80s they can have it back 🙂

10:47:38 am InvestorsLive: MTSL very small float just FYI — so don’t underestimate but be sure to pay yourself given the move

10:47:46 am InvestorsLive: i am not taking off radar if the dips keep getting soaked

10:47:52 am InvestorsLive: only takes 1 major player to soak it

10:47:38 am InvestorsLive: very small float just FYI — so don’t underestimate but be sure to pay yourself given the move

10:47:46 am InvestorsLive: i am not taking off radar if the dips keep getting soaked

10:47:52 am InvestorsLive: only takes 1 major player to soak it

10:48:10 am InvestorsLive: and again — not getting uber bullish here – I’ve locked in quite a bit just not afraid to re add if they start taking it up later

10:59:18 am InvestorsLive: MTSL yep

10:59:22 am InvestorsLive: all it takes is one guy

10:59:41 am InvestorsLive: They trapped $2 $2.05 and $2.20s 3 times – and haven’t let them cover

10:59:44 am InvestorsLive: do not underestimate this

11:04:13 am InvestorsLive: Monster soak MTSL

11:08:33 am InvestorsLive: MTSL all that matters is what they do w/ it off the dips if it stays heavy – be aware if they soak then likely game time later

11:09:27 am InvestorsLive: Only way to trade it is — sell every ramp/parabolic buy when no one wants — and keep flyer around core and if it bust HODs and starts thinning up then patience

11:13:47 am InvestorsLive: MTSL imo best not to find bottom they just trapped a ton of longs on this pull

11:13:52 am InvestorsLive: so they need to work them out and clean it up imo

11:14:09 am InvestorsLive: rather buy dips after the turn or wash out candle only — ideally nail it again

11:16:34 am InvestorsLive: MTSL – is quiet trade again for me when no one wants – I think needs one more flush out then pick pieces

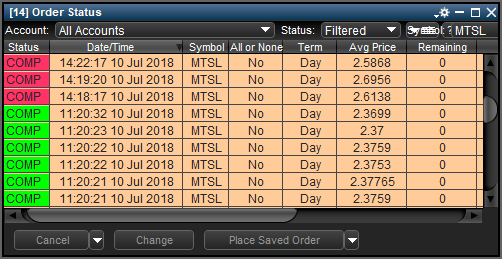

11:20:06 am InvestorsLive: Buyer soaking back MTSL 4 x float almost

11:22:27 am InvestorsLive: Here is the flush

11:22:49 am InvestorsLive: now trading plan — if $2 fails to reclaim then I think buyer failed

11:22:55 am InvestorsLive: bailed *

11:23:33 am InvestorsLive: Hope comments help

11:23:45 am InvestorsLive: when sh*t gets long crowded only one way to get longs out — and its like that

11:23:53 am JayTaylor: For sure the comments help!!

11:24:39 am InvestorsLive: be aware of it — everyone same page next XYZ etc — not only do you need to be patient on entry you need to wait for all the longs who had been dip buying on way down to hit their point of panic

11:24:50 am InvestorsLive: and it still may fail but point is — entry

11:30:06 am InvestorsLive: Cautious on MTSL if in there – per comments re: if trouble at $2 — that’s key level later on $2.05 in my eyes

11:39:09 am InvestorsLive: MTSL feels like buyer got bagged there again — to me this is a keep on radar and join when it thins up vs. whatever the recent lows are

11:45:03 am InvestorsLive: MTSL — so my game plan is dips if no stuffs then only size would be $2.05 + reclaim only 1/2 + would be over VWAP — until then assume buyer got stuck and all rebounds fail — for most I’d wait for it to retake trend keep u out of a big head ache more that are long biased here the more it will yank if it stuffs/fails aka the few candles we saw anticipating that wash out

11:45:17 am InvestorsLive: if new I’d avoid until $2-2.05 reclaims or 2pm + personally

12:03:28 pm InvestorsLive: This action on MTSL is what I refer to as ‘cleaning it up’

12:03:41 pm InvestorsLive: working out all the baggies, working out all the average down guys

12:03:48 pm InvestorsLive: lots of false break outs shake them of their shares

12:03:59 pm InvestorsLive: process that it has to go through if it’s going to have another leg

12:09:44 pm msheldon: MTSL with a small lunch time ramp

12:12:46 pm InvestorsLive: Note the large offer on MTSL but $2.05 soaking again?

12:17:39 pm InvestorsLive: MTSL nice re-test $2s so far that’s what you want to see you need to assume that all rebounds sub VWAP are stuffed

12:17:45 pm InvestorsLive: Then let it come in test – and prove new base

12:17:57 pm InvestorsLive: if it takes $2.10s next round it’ll likely be fast but remember still sub VWAP

12:18:16 pm InvestorsLive: so you should be paying yourself if any size – and cautious with adds until trend proves over VWAP

12:26:12 pm InvestorsLive: MTSL $2.27 hidden buyer so far

12:26:16 pm InvestorsLive: soaking away

12:30:21 pm InvestorsLive: MTSL 🙂

12:32:45 pm davrik86: what a save

12:33:05 pm InvestorsLive: Aweosme trade all

12:33:10 pm InvestorsLive: This is a buck here

12:33:15 pm InvestorsLive: doesn’t get much better than that — be smart along way

12:56:20 pm InvestorsLive: MTSL offers coming to party — like when bid holds and big offers show

01:18:59 pm InvestorsLive: MTSL is still 50/50 here — risk is they are doing what they have to keep price up … but what i see so far is $2.20 picking away soaking

01:19:04 pm InvestorsLive: But not in a rush so far

01:19:32 pm InvestorsLive: letting folks out — but slowly taking in size — good if they ramp it back up bad if they get stuck with it — so for me I prefer to wait for confirm to add any of the sells

01:19:51 pm InvestorsLive: only edge = wash or dips on trend after confirm but imo working out weak / cleaning it up then 2pm + we’ll see if they turn on jets

01:20:00 pm InvestorsLive: Too bad it wasn’t easy to borrow it’d probably be $7 by now

01:28:54 pm InvestorsLive: Hey MTSL how you doin’

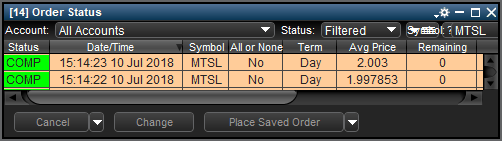

01:30:05 pm InvestorsLive: I have to leave at 2:20PM for quick appointment fwiw and will be back for final hour

01:52:45 pm InvestorsLive: When and if they do take MTSL up it will not be like last hour

01:52:56 pm InvestorsLive: It’s going to be steady bid that don’t downtick

01:54:52 pm InvestorsLive: And she’s off

02:10:26 pm InvestorsLive: MTSL so far perfect — $2.60s that squeeze trigger imo

02:10:30 pm InvestorsLive: like GBR that day

02:10:44 pm ThePacer: yep^

02:10:46 pm InvestorsLive: $2.60 is the confirmation rather $2.80 prior high likely trigger

02:12:39 pm InvestorsLive: been video taping thsi move w/ commentary like I have been putting in the room so will be a treat for later

02:18:49 pm InvestorsLive: MTSL pretty spot on :up

02:21:13 pm InvestorsLive: Gotta run for a few – will be back I locked in a few along way – pretty nice guys :up goal will be to let some work into tomorrow and/or weak open for a rally back

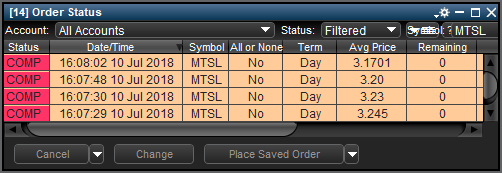

03:10:08 pm InvestorsLive: MTSL those $2.65-2.70 sells looking pretty now

03:48:37 pm InvestorsLive: MTSL what a save

03:48:45 pm InvestorsLive: This is good — gonna be a fun one tomorrow

03:49:43 pm JimTilton: Sweet ^

03:52:15 pm InvestorsLive: I will carry small over

03:55:13 pm InvestorsLive: unreal trap there

04:00:13 pm tradertaxCPA: sick eod trap there on MTSL

04:02:02 pm InvestorsLive: MTSL !

04:03:37 pm InvestorsLive: Form 3 situation coming?

04:05:51 pm Tj13: awesome read earlier Nate off 1.70s

04:06:49 pm JimTilton: Honestly Nate, great read and guidelines/what to watch on , great lesson today – all day long

04:07:04 pm Tj13: exactly play by play nj

04:07:16 pm InvestorsLive: !!!!!!!!!!!!!!!!!!!

04:07:36 pm InvestorsLive: locked a few

04:07:43 pm InvestorsLive: rest for $5-7 or $10?

04:07:44 pm InvestorsLive: lol

04:08:01 pm Moe: Yea Nate I have no idea how you were able to tell it was all a big trap. It looked really stuffy to me. But I kept adding on the dips and made bank

04:11:40 pm PapaG: Just want to say all, relatively new trader. and I feel I am learning a lot. Good service, really love the chat room features. A great many features that set it apart from the others.

04:12:35 pm btr8er: Nice call on that MTSL … I almost got faked out towards the end

04:12:56 pm InvestorsLive: as you should have

04:12:59 pm InvestorsLive: that was the entire game plan

04:13:06 pm InvestorsLive: they push you to the brink

How did you find this stock?

Scanners. Trading software has all types of scanners that tell you what’s moving. Like biggest % gainers scan. …

Thanks Nate

Great blog nate. I’m not in your room no more but I did buy and love your dvds. Also still follow a lot of what you do and it’s aleays very helpful thanks a lot

Awesome video Nate……..Thanks for sharing

The video is an amazing walk through live trade. I try not taking for granted any help I can get and a big thank you goes to Nate for this free gift. I thought the first dip, being a over 50% retracement , would be the end of the up-move too but Nate explains all of the factors, including float rotation, stuffing and, most importantly, the psychology behind “Them” and the rest of the (retail) traders out there. If you don’t watch the entire video (twice maybe), you are a fool!!

Thank you so much. This was very helpful 🙂

THE BEST VIDEO I HAVE SEEN IN THE TIME I HAVE STUDIED. MANY THANKS NATHAN. IF GOD WANTS SOON I WILL BE IN YOUR CHATROOM LEARNING MORE FROM YOU

The recorded/ walkthrough video recaps are great, they help out a lot man thanks

Great video – without a doubt. What type of size/number of shares are you using for a trade like this?

Thank you Nate.

Hey Nate,

Just wanted to say:

I am a tim challenge student and seriously it has been a total waste of my money.There is not a single video that explains the mechanics of a trade like this. he just says buy dips. That’s what i paid more than 6k for. I seriously wish I joined IU and did my research. I have learnt about ferarris and 5 star hotels around the world though. The content difference is so vast that you can’t even compare. Thank you so much for these vids.

Thank you!

great work. This vidéo is massive.

Wow, nice priceless information here. Thank you.

thank you for great video Nate, you said in others video, you rarely trade day time, in this trade as well your entry after 3 pm have more profit than others trade. My question is why did not you out of trade when it break down 2.20s level or it fails to b/o 2.60s? did you put any stop loss while going out? thank you

AMAZING INFORMATION – THANKS NATE!@#@!#!@#@!#@!#

Thanks Nate, Leny