Adding

Adding shares to an existing position.

Examples:

Adding INTC

Looking to add TEVA if VWAP fails

All done (Done w/)

Closing out a position.

Examples:

All done SHOP

Done w/ MARA for now

Bases/Basing

A stock is forming an intraday base (support level) after a pullback or gap down.

Examples:

SNAP based at 20

Waiting for TRIP to base before going long

Bid/Bidder

When a stock has a relatively large order (buyer) on the bid, as shown on a level 2 screen.

Examples:

SNAP bidder

PTI bidder filled

Buying on Dips

Buying shares in anticipation of a breakout, allowing for a better price average. For example. If a stock breaks out above 5, hits 5.50, and you expect it to go to 6, you may wait for the stock to pullback to 5.30 before entering a position.

Examples:

Adding WMT on dips

Will add SNAP on dips if trend holds

Chase/Chasing

Entering a position after a stock has moved up or down quickly. For example, if a stock runs 10% in 3 minutes without pulling back, going long may be considered chasing.

Examples:

Avoid chasing RIOT

Added small TRIP – chase entry

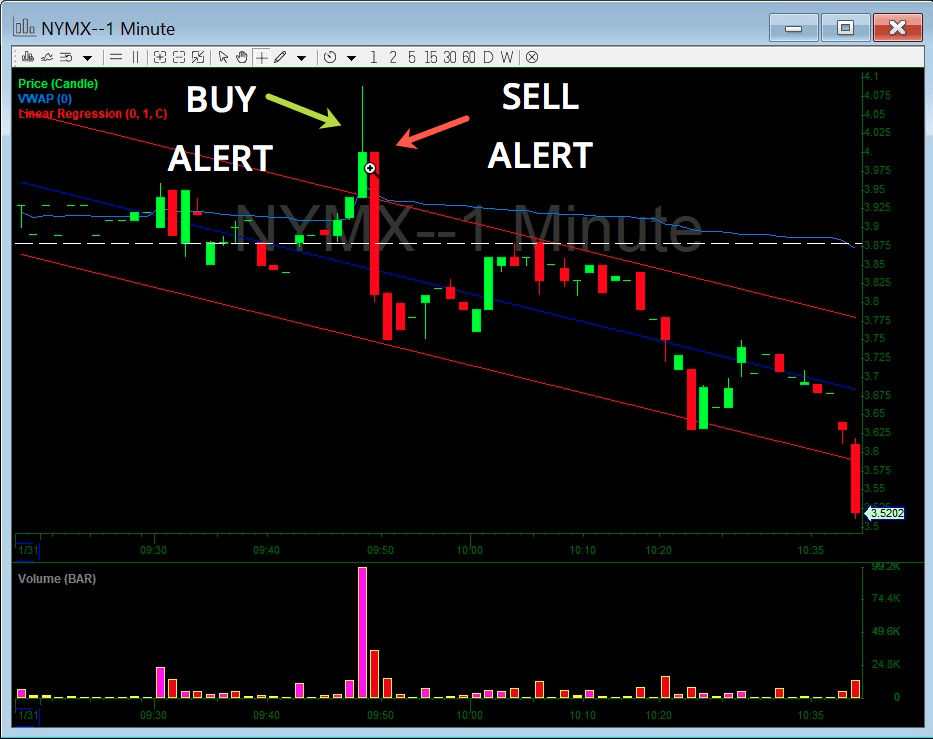

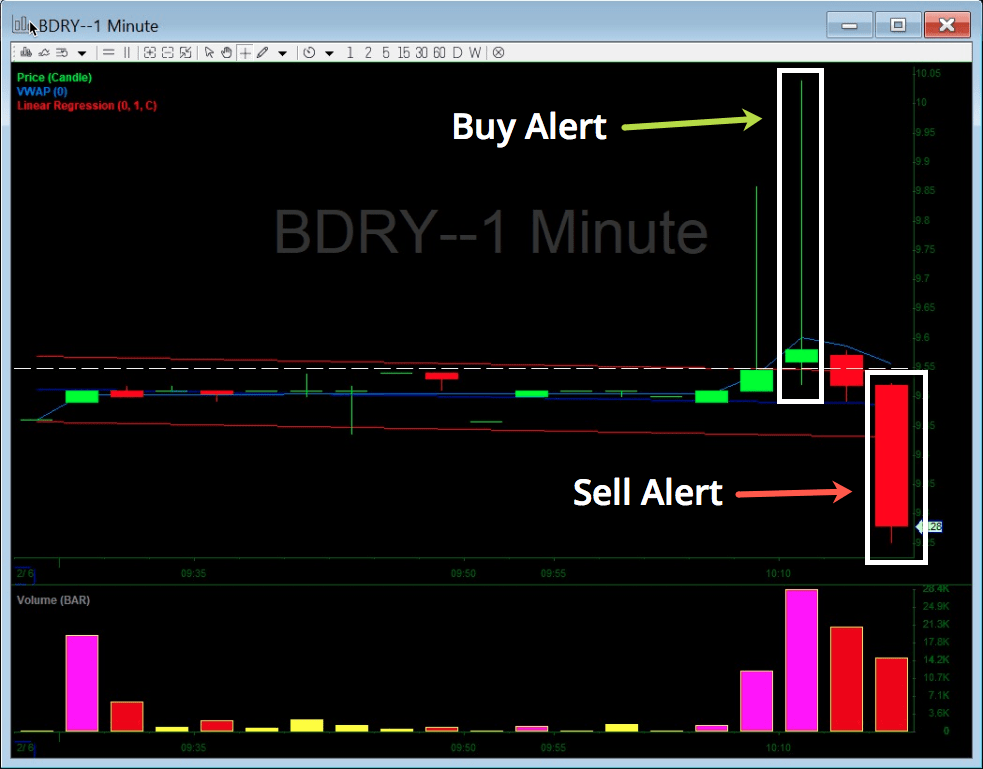

Chat pump

A stock is being promoted by a chat room or newsletter, leading to an artificial increase in volume. We want to be conscious of this because the chat room “sell alert” could lead to a similar artificial pullback.

Examples:

LBCC chat pump – be cautious

AQMS crowded chat pump

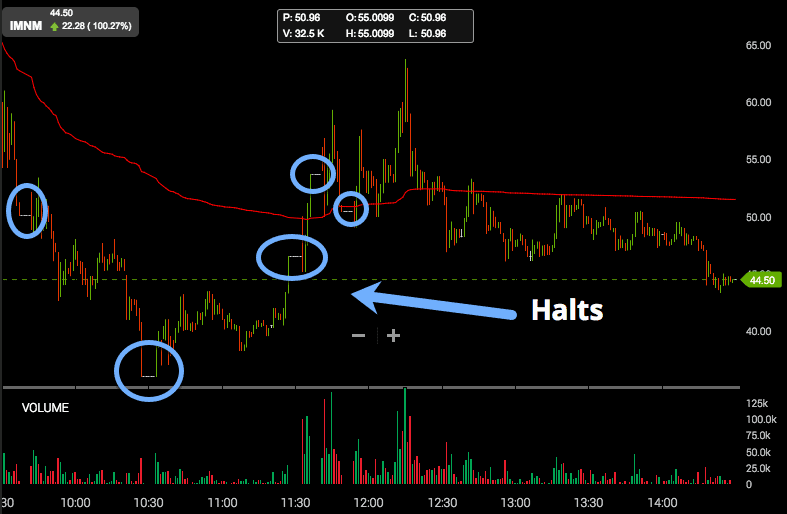

Circuits (Halt)

Circuit halts are triggered when stocks experience exceptional volatility in a short period of time. During these halts, all trading activity is “halted.” You cannot buy or sell shares until trading resumes. It can be helpful for traders to recognize when a stock is susceptible to a halt (and at what price levels) so they can avoid getting stuck in a position of uncertainty. For more details on circuit halts, check out the official documentation on the Nasdaq website.

Examples:

Circuit at $15.40 SCKT

PPIH Swipes to circuit

GTEC halted

Close/Closer

A stock is moving closer to an area of interest. For example, a stock may be close to breaking out or breaking down.

Examples:

RAD closer

VWAP test close SPY

Core position

A core position is the position you build in anticipation of a bigger move. You may take advantage of smaller intraday price movement while still holding onto a core position. For example, if a stock dips to $9 in the morning, you may buy shares, expecting the stock to run to $11 by the end of the day. In the meantime, you may take smaller positions in the middle of the day to lock in gains.

Examples:

NVDA trading around core

Locking some FB around core

Adding WMT to core

Crowded

A stock may be considered “crowded” when there are a bunch of traders trading the same idea. For example, if everyone is short RIOT, this may make it easier for the stock to squeeze. Similarly, if a stock is a crowded long, it may lead to a breakdown as traders cut losses.

Examples:

XNET crowded short

Avoiding SNAP crowded long

EOD

EOD stands for “end-of-day” and refers to how a stock will behave towards market close. The last hour of trading is generally more volatile than mid-day.

Examples:

WMT looking for EOD ramp

All done MDXG – will revisit EOD

Failed Follow Through

Failed follow through occurs when a stock tries to break out and gets rejected. This can often lead to a trend reversal or pullback. This may be a good time to exit a long position or initiate a short position.

Examples:

AMAT failed follow through

Adding SQ short on failed follow through

Fresh highs/lows

When stock has been running consolidating for a bit and makes a move towards new highs or lows. The goal is to draw attention to a stock that was previously struggling at highs/lows and now breaking above/below (meaning it’s back on radar).

Examples:

HTGM fresh highs

OSTK fresh lows

Gapper

A stock is generally considered a “gapper” if you plan to hold it into the next day. When a stock is running during the day, and closes on its highs – one might look to gap it to take advantage of possible follow thru the following morning

Examples:

SNAP is a gapper for me

Took some HTGM gapper

Guide

Guides are the price levels you use to navigate a trade. These are generally key price areas for a particular stock. For example, a stock is trading above VWAP, you may use VWAP as your guide for risk on a long trade.

Examples:

Using 13.80 as a guide on FOSL

Buying dips on MBI – $8 guide

Adding SQ short w/ VWAP guide

Heavy

A “heavy” stock struggles to gain upward momentum, making it a potential candidate for a short trade. The stock may be setting lower highs or experiencing failed follow through.

Examples:

SPY heavy

Locked DBVT but will re add if it stays heavy

HOD/LOD

“High of day” and “low of day” – referring to the high and low prices for the day.

Examples:

Short VRX – risking to HOD

Scooping some OMER risk to LOD

Holding trend

Holding trend (or “holding”) refers to a stock that is in an uptrend or downtrend. The stock may experience pullbacks or spikes, but is still following a specific trend for the day.

Examples:

GNC holding trend

NUGT holding trend – will wait for VWAP fail for short

Halt

When a stock halts, trading is temporarily paused and you cannot buy or sell shares. Halts can last for a few minutes or for days. There is inherent risk to holding a position into a halt because you do not know how the stock will react when trading reopens.

Examples:

APRI into halt

INPX about to halt

Higher Better

Allowing a stock to move higher while anticipating the short play. The higher the stock goes, the better the short opportunity will be.

Examples:

RIOT higher better but looking for failed follow through

CATM higher better. Look for the fade off later in the day

Key Areas

Key areas and levels are price points of interest. These are generally support/resistance levels that can be used for risk. For example, if a stock is trying to break above $20 all day, $20 would be a key area. A break above $20 would confirm a breakout and a rejection off $20 may represent failed follow through momentum.

Examples:

Key level on ANTH is $2.55

Watch the key levels on TRIP

Leaving Room

Giving a trade some space to work while anticipating risk and sizing accordingly (generally while scaling in with an early entry). For example, if you are long a stock at $5.50, you may choose a position size that allows the stock to move to $5 without taking on an uncomfortable amount of risk. You are “leaving room” for $5, meaning you won’t get stopped out. Think of this as “wiggle room” to make a trade work.

Examples:

Adding VRX short – leaving room to .90s

Took starter VXX – leaving room to $45

Locking In

Closing out part (or all) of a position. You can lock in gains, meaning you are turning profits from unrealized to realized.

Examples:

Locking in 1/3 GRPN

Nice ramp ZN – Lock in gains along the way!

Magnet

A psychological price level that a stock is drawn to (generally whole and half dollar marks). For example, a stock trading at $4.7 may have a $5 magnet, meaning it is drawn to that price (which may later act as resistance).

Examples:

$200 magnet on NFLX

WMT $92 magnet

Moving on Air

When a stock experiences high volatility on low volume. For example, if a stock runs from $10 to $12 on low volume, it could be considered to be “moving on air.” The key here is volume.

Examples:

OSTK moving on air

LFIN floating on air

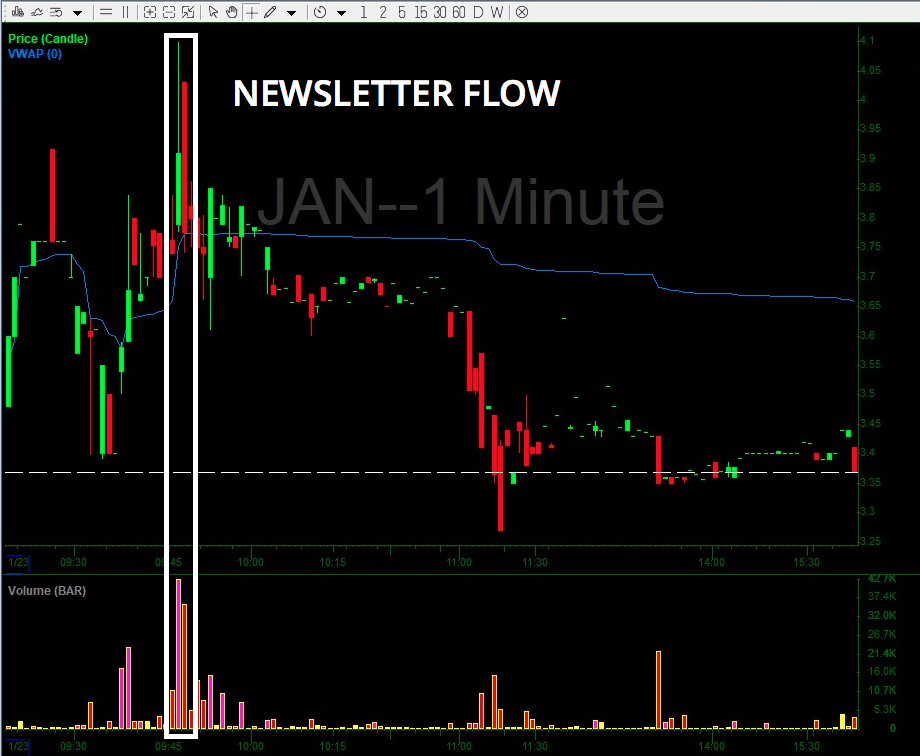

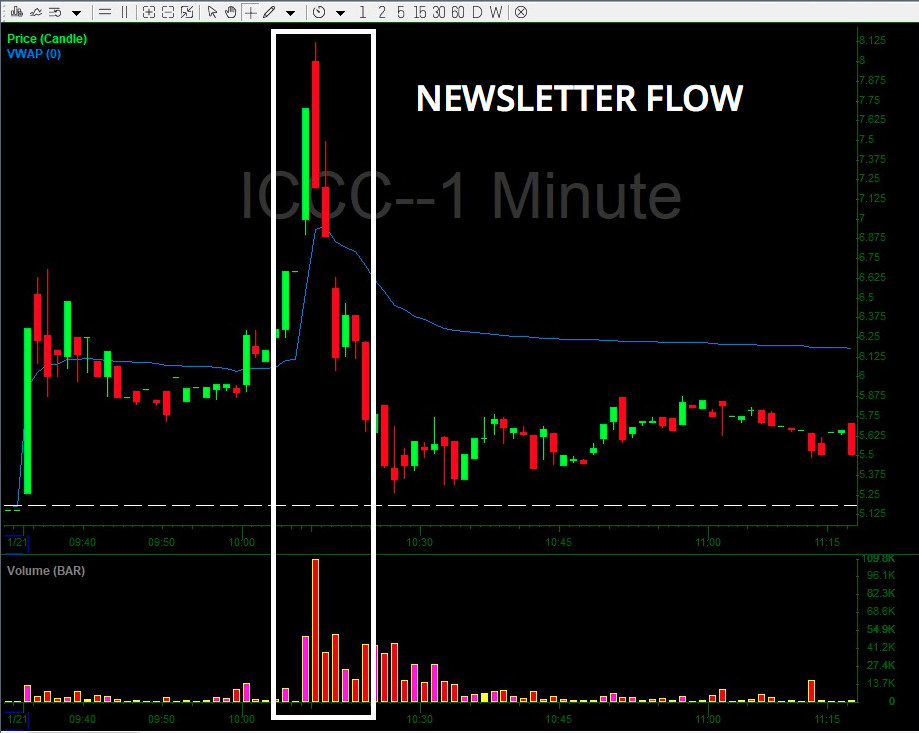

Newsletter

A “newsletter” is a third party that we’ve identified influences the market with their buy and sell alerts. This may be a chat room, newsletter or alert service. These third parties bring in non-organic buying that may allude to a stock’s future trading behavior.

Whereas organic breakouts bring real buyers who are building positions based on technicals, fundamentals, or news catalysts, non-organic breakouts (i.e. newsletter buys) represent buyers who are building positions solely because they received an alert from a service of chat room. These buyers are patiently awaiting a sell alert from that service or chat room that issued the initial buy alert. This means that the mass buying that sent the stock price up will eventually be met by mass selling that could send the stock price right back down.

When a newsletter alerts to the masses (typically selling within 10 seconds to 2 minutes into the volume they’ve created) you can assume that ALL the volume you just saw come in on the offer is likely going to come back on the bid. Therefore, 90% of the time it’s good to be aware, stay clear and understand why a particular stock moved when it did. Typically less toxic newsletter alerts happen after 11AM and don’t share the same characteristics as earlier alerts.

We will alert these situations as “newsletter” alerts. Out of respect, we will not share the names of the specific services behind the alerts.

Examples:

just sold a boat load JAN into newsletter per rules

IGCC newsletter

Next Leg Up/Down

As a stock trends up or down, it may find periods of consolidation before making another move up/down. For example, a stock may drop from $15 to $12, consolidate at $12, and then keep moving down. This move would be considered the “next leg down.”

Examples:

VXX next leg

HTGM next leg up

Non-Stop Fade

A stock that is slowly trending down all day.

TEVA non-stop fade

AAPL non-stop fade from open

On radar

A stock is considered to be “on radar” if it is setting up for a trade but not yet ready. For example, if you are waiting for an ABCD formation to complete, the stock may be on radar. A stock may also be taken “off radar” if the setup breaks.

Examples:

CALA on radar for EOD move

TWTR on radar for HOD break

On/Off VWAP

Analyzing how a stock reacts to the VWAP technical indicator. For example, if a stock is pulling back it may test the VWAP price level, meaning it is on VWAP. If VWAP holds as support and the stock keeps moving up, it would be considered “off VWAP.”

Examples:

SPY on VWAP

Adding GRPN off VWAP. Using VWAP as guide

Over/Under

A price level (similar to a magnet) where a stock consolidates before choosing the next price direction. These may be levels where you choose to set your risk. For example, if a stock is at $50.50, you may set your risk to “over/under” $50 to see how the stock reacts in that price area.

Examples:

CNET risking to 6.80s over/under

Eyeing KODK – will see how it reacts over/under VWAP

Pay Along The Way

If a trade moves in your favor, you should take profits along the way. This is the same as “locking in” profits. The goal is to make sure you don’t get greedy and turn a winner into a loser.

Examples:

Nice move on UVXY – pay yourself along the way

TEVA perfect. make sure to pay yourself

Perking/Gearing/Curling

Gearing, perking, and curling, refer to a stock’s price action when it starts to break above a channel or level of resistance. This may allude to a potential change in momentum.

Examples:

DPW perk

OREX perking

Pops

Short-term price spikes (generally referred to during a down trend). Whereas, you may buy on dips for a breakout, you may short on pops for a breakdown.

Examples:

Shorting all pops RAD

Leaning into pops MDXG

Push/Pull

A short term downward move (pull) or upward move (push). A push or pull may come before an increase in momentum.

Examples:

ROKU pull

HMNY .30 push

Ramp

A move upward that starts getting going, but isn’t big enough to label parabolic (identified by its “ramp” shape).

Examples:

SPY ramp

QCOM ramp

Reclaim

When a stock fails to hold a certain level and later breaks above it. For example, a stock may break below VWAP only to “reclaim” it later.

Examples:

SPY VWAP reclaim

Will wait for TWTR to reclaim VWAP before adding size

Red/Green (R/G)

When a stock moves from red (negative on the day) to green (positive on the day). This shift in sentiment is often followed by a boost of momentum.

Examples:

SPY testing r/g

AAPL r/g

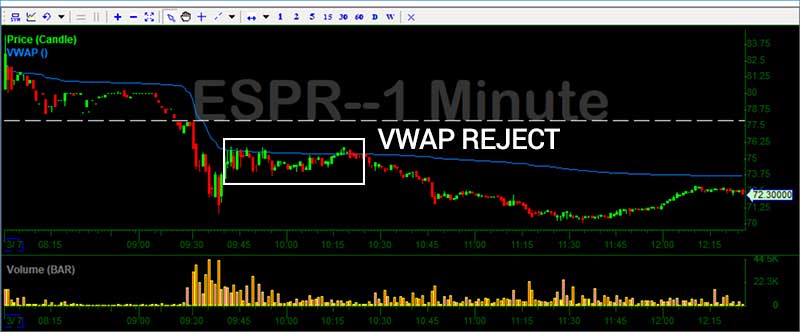

Reject

When a stock fails to break above a certain level, such as the high-of-day or VWAP.

Examples:

ESPR reject off VWAP

TWTR HOD reject

Revisit Later

Temporarily taking a trade off radar with plans to revisit it at a later point. For example, if you are expecting a breakout on SNAP but it keeps rejecting the high-of-day, you may take it off radar and revisit it after some consolidation.

Examples:

Done SNAP for now – will revisit tomorrow

Leaving HTZ alone for now – will revisit later

Risking To

Your stop loss area (mental or hard stop), based on key price levels. For example, if a stock has support at $7, you may risk to $7.

Example:

Adding HMNY long. Risking to VWAP

Short VRX. risking to HOD

TWTR trading nicely. Moving risk to entry

Scale/Scaling in

Building a position using multiple orders. This is a strategy for balancing risk and conviction. For example, if you wait for a stock to breakout, you have confirmation of the move (higher certainty) but will get a worse entry (higher risk). If you anticipate a break out, you will get a better entry (lower risk) but have less certainty. Scaling in allows you to balance the two approaches. You may add 1/2 your position in anticipation of a breakout and the other 1/2 after confirmation of the breakout.

Examples:

Scaling into VXX on dips.

Added 1/2 size NFLX

Covered 1/3 NUGT

Slam/Stuff

A sudden downward move, often backed by higher volume. Think of this as someone “slamming” the bid with high order volume.

Examples:

OSTK nice slam

PTI slam

Starting (Long or Short)

The process of initiating a position with intent to scale in.

Examples:

Starting in SHOP

MARA starter. Waiting for confirmation

Steady Fade/Grind

A weak but consistent move upward (grind) or downward (fade). These are generally lower volume, lower volatility moves.

Examples:

CYH steady grind

MIC steady fade all day

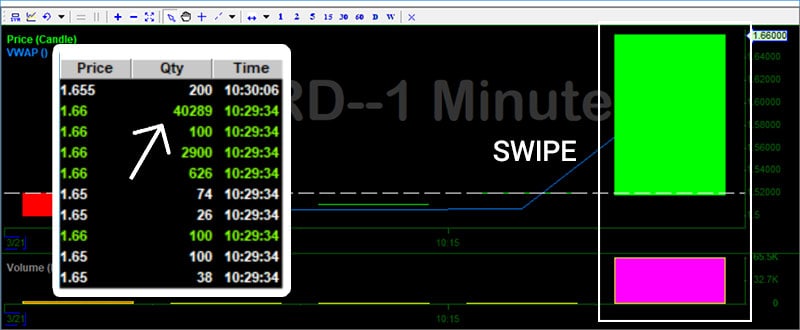

Swipe

A sudden upward move backed by volume. Think of this as someone “swiping” the offers on the ask.

Examples:

MYSZ .20 swipe

ECYT swipe

Thin/Low Float

A stock that with higher volatility due to a low float. A “float” is a stock’s supply, and stocks with lower floats can experience higher volatility on lower volume.

Examples:

KBIO thin. Could go to 20

RIOT low floater

Trending

A stock moving in one direction (up or down) with low volatility.

Examples:

TWTR trending

CHK big trend today

Unwinding

A stock that is downtrending with very few popups and no signs of reversal.

Examples:

MIC unwinding

OMER steady unwind – dont try to catch the bottom

Washout/Wash

The price action of a stock moving downward, generally experiencing above average volatility. Think of this as “washing out” the previous owners as stop losses are hit.

Examples:

Looking for a $77 washout on W

Adding shares of ROKU off the wash

Leaning

Slowly sizing into a short position.

Examples:

Leaning into SLCA small size

Looking to lean into pops on TRIP if this continues to fade

Squeezing

A stock that is moving upward due to shorts covering their positions.

Examples:

XNET squeezing shorts right now

OSTK squeezing early shorts

Everyone is short VRX right now – may start squeezing above VWAP

Volume

An alert related to higher relative intraday volume.

Examples:

ACRX volume

Volume building NETE