2020 has been a historic year for day trading. Millions of new traders have entered the market and it’s actually having an impact on how stocks trade.

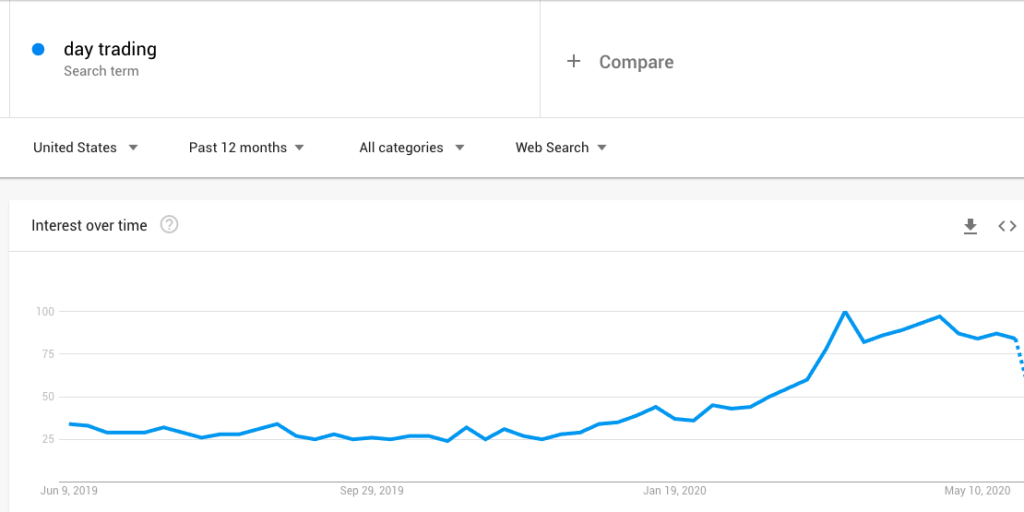

Just take a look at this Google Trends chart for “day trading”:

The interest in trading spiked. Brokers have reported that millions of new accounts have been opened in the past few months.

These are unprecedented times.

Today, we’re going to focus on two things:

- How these new traders impact the market

- How new traders can set themselves up for success or failure

First, let’s set the stage by talking about where these new traders are coming from.

Where Are These Traders Coming From?

As a trader, you need to understand your fellow market participants. Market participants will have a major impact on how stocks trade. When you see millions of new traders enter the market, you should ask yourself, “where are they coming from?”

In this case, we can only speculate based on anecdotal evidence, but the evidence is still pretty strong.

There are a few key events to consider:

- People have been staying home

- Many gambling industries shut down (i.e. sports betting, casinos, etc.)

- The market has been incredibly volatile

By considering these events, we can conclude that a lot of amateur gamblers have turned to the market for their thrills. The keywords here are “amateur” and “gamblers.”

Many people have switched from gambling to trading. Others have turned to trading to replace lost income. The outcome is still the same – we have a bunch of uneducated money entering the markets.

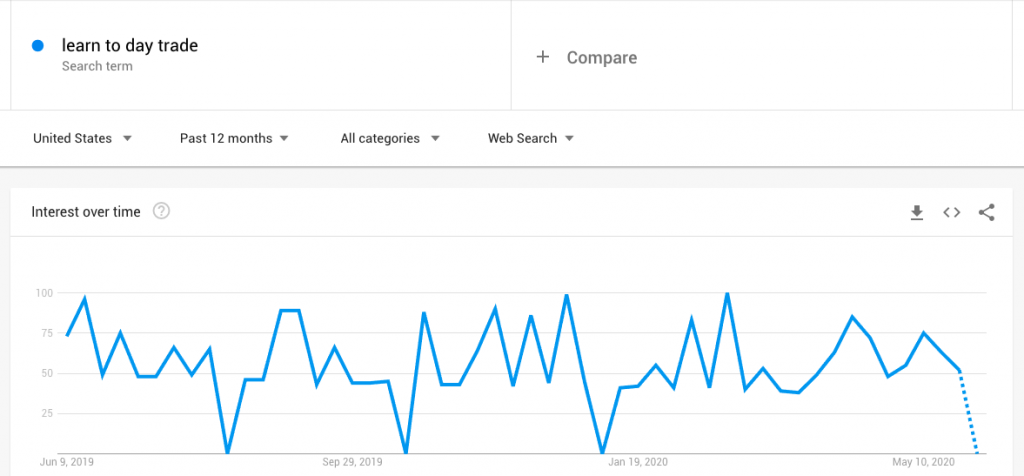

That’s not a critique. It’s the truth. We saw millions of traders enter the market. These new traders are thirsty for trading not learning. We saw the spike in search volume for “day trading” above. Here’s the stable trend for “learn to day trade.”

Everyone wants to trade – no one wants to learn.

This isn’t a pitch for education. We’re using this information to better understand the current market participants.

Let’s take a look at how these traders are impacting the market.

How New Traders Are Impacting the Market

It’s clear that a boatload of uneducated money has entered the markets. The next question is, “why does it matter?”

It should be clear that market participants can impact the way stocks trade. For example, if 100% of the market is bullish on a stock, the stock will go up in price because everyone will be buying and no one will be selling.

So, what happens when a bunch of uneducated traders enter the markets?

New themes emerge.

Traders are short-sighted (especially those with shorter careers). They are constantly looking for the next “hot trade” relative to the last hot trade. For example, if a biotech company goes nuts on Monday, traders are more likely to pile into another biotech company on Tuesday.

As these trends and themes become apparent, experienced traders adapt and inexperienced traders get lured into traps. For example, as small caps go wild (theme), experienced short sellers will become more patient while inexperienced long traders will become more impatient.

So, how do you avoid traps in the market right now? The first step is recognizing them.

Stock Market Traps

Recency Bias

The recency bias is a psychological phenomenon that explains how people assign too much weight to recent events. With regard to the market, this bias explains that people tend to assign too much weight to short-term trends over long-term trends. For example, if a stock is up 100% in two years, but down 20% in the past month, the stock may look weak, when in reality the company has been performing well over the past couple of years.

Right now, everyone is focused on the market’s recent rally. The market is up ~40% off its lows in the past couple of months. If you’ve been buying stocks in the past couple months, you’ve been making money. Making money is good, but if you come away with the wrong takeaways, you may lose money in the long run. This leads to the next point.

Rewarded for Recklessness

As traders, our goal is to make money. That said, we don’t want to make money by luck or accident. We want to make money because we have effective trading strategies.

In this market, it has been easy to make money on accident. Everything has been going up for the past couple of months and many traders have been rewarded for recklessness.

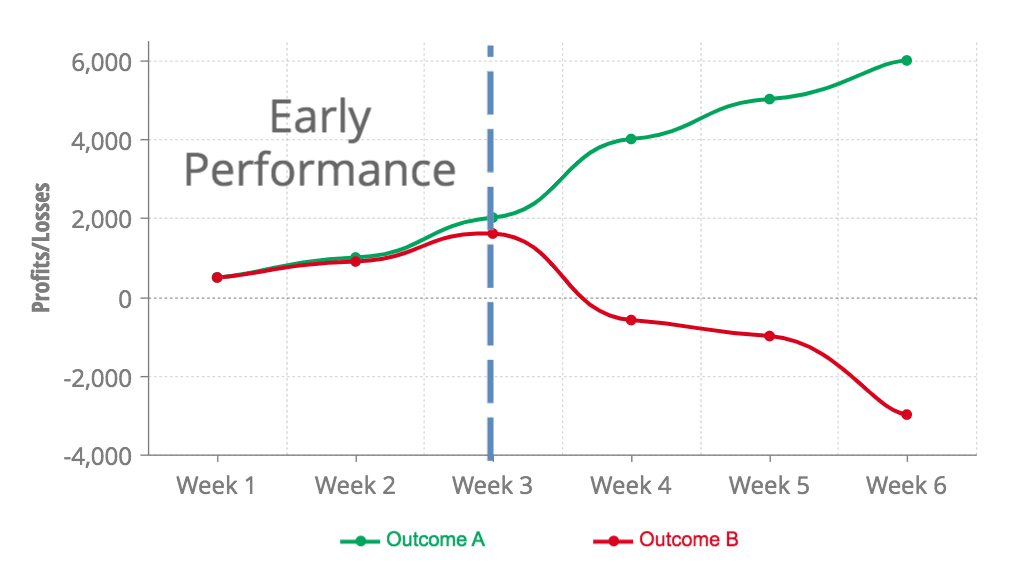

Take the following example to illustrate the point.

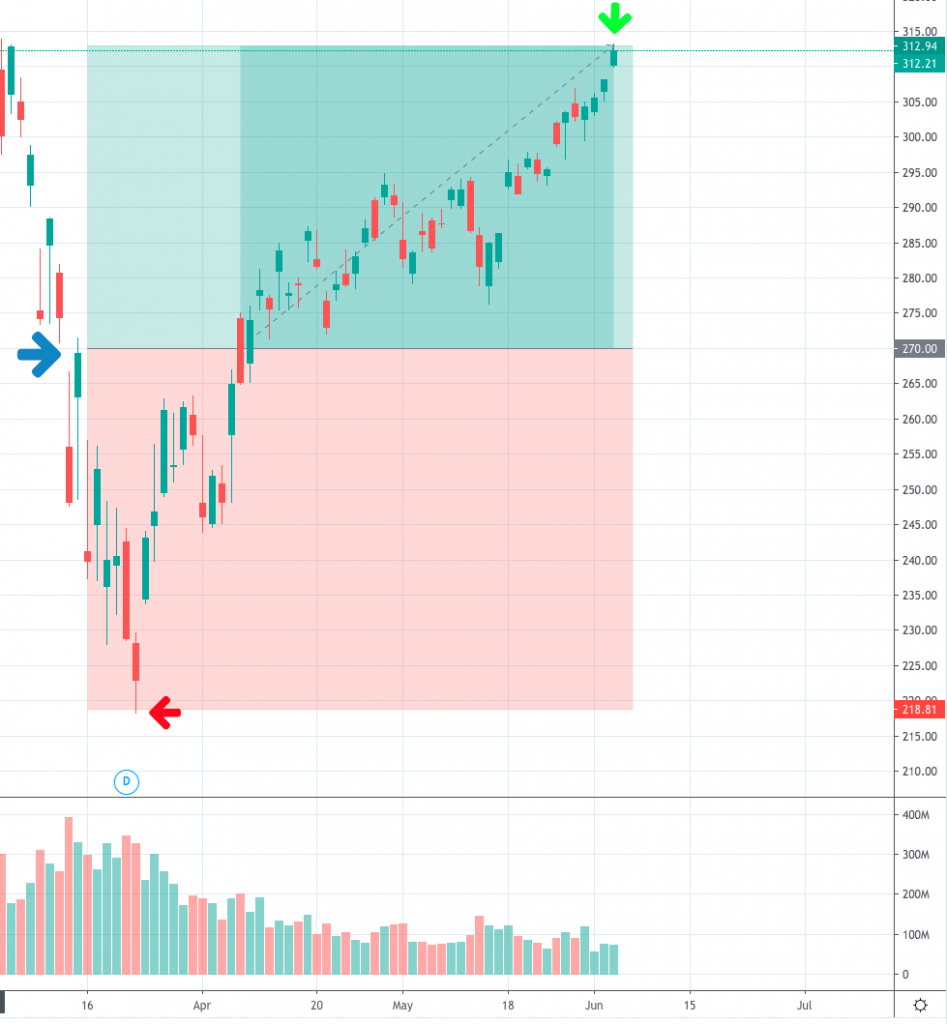

You were trying to guess the market bottom in March and you went all-in on the SPY at $270.

Let’s assume you bought 100 shares. You would be up over $4,000 on that trade as of today. That’s pretty good right?

Not really…

That is a perfect example of getting rewarded for recklessness. There are many things we know to be wrong with that trade:

- You shouldn’t ever try to predict bottoms (don’t fight the trend)

- You shouldn’t go all-in on speculative trades

- You should cut losses early (at one point, you would have been down $5,000 on that trade)

We all love making money, but nobody wants to be a sucker. If you are rewarded for recklessness, at least recognize it. If you think you’ve been rewarded for your impeccable strategy, you are putting yourself in a precarious position. Eventually, your recklessness will not be rewarded and you will lose more than you’ve gained.

FOMO

FOMO is the “fear of missing out” and I can’t think of anywhere it’s more prevalent than the stock market. Everyone wants to catch the next “hot stock” or “life changing trade.” Maybe you watched a trade slip away from you or maybe you saw another amateur trader post a screenshot of a 5/6-figure profit.

FOMO clouds your judgment. If you are entering trades just because you don’t want to miss out, you are an emotional gambler, not a trader.

Check your emotions and get in the habit of formulating strong trade hypotheses.

False Equivalencies

Traders are always looking for correlations in the market. Just turn on CNBC and see how they talk about market price action. “Well, in 1987 the market did this…” “In 2008, the market rebounded before doing X….” When the future is unclear, we look to history for guidance.

Traders often assume that historical data is an accurate predictor of future price action. While this is the foundation of the technical trading we do at Investors Underground, it relies on an accurate analysis of historical data. If you get the analysis right, you have a great trade on your hands. If you get it wrong, you’ve made a false equivalency that will be costly.

We’ve been seeing this a lot with recent market themes. Company A puts out a press release that mentions COVID and they double, so traders assume the next company that puts out a similar press release will do the same. Traders assume that what worked before will work again, but that’s not always the case.

Be cautious about making false equivalencies. You can avoid this trap by analyzing the nuances of each individual situation.

Unsubstantiated Confidence

The last trap we are going to discuss is a costly one that ties all of the other traps together. Many new traders have been repeatedly rewarded for recklessness and have become confident in their reckless ways.

They have been rewarded for bad behavior and that bad behavior is becoming a habit. Danger is lurking around the corner.

Take our hypothetical SPY example from above. If a trader has been rewarded for guessing bottoms, they will assume that its a sound strategy. While it may have worked for a few trades, it will ultimately lead to wreckage.

All it takes is one trade to take you out of the game. Check yourself. Leave your ego at the door and learn to recognize your good and bad habits. There’s a thin line between confidence and arrogance, and once that line is crossed, demise is inevitable.

How to Thrive in This Market (A Message to New Traders)

If you’re new to trading, you need to develop the right habits now. If you develop the right habits, you can build a skill set that will pay you for years to come. If you get locked into bad habits, you’re a ticking timebomb. You may make money in the short-term, but you will give it all back in the long-term. Here are some key lessons to guide you on your journey.

Learn First, Trade Second

Everyone who enters the world of trading is excited to start placing trades. Trading is exhilarating – learning is tedious. That said, education is essential to your trading success. If you are new to trading, your goal should be to soak up as much information as possible.

If you’re in a rush to place trades before you learn how to trade, you have the wrong mindset. Education will help you thrive in the markets. There’s no rush to start placing trades. If you develop a skillset, you will have a lifetime to collect paychecks from the stock market.

Understand Your Environment

The market by its very nature is dynamic. Trends are constantly changing and the traders who succeed are those that study the market environment. You should constantly be asking:

- What is working now?

- What are the current market themes?

- Why is this working right now?

- Is this a short-term strategy or a long-term strategy?

The answers to these questions will paint a more accurate picture of the current environment.

For example, if you entered the market right now and only paid attention to short-term trends, you would assume that virus-related stocks always run. We know that’s not the case. You may also assume that small cap stocks are always hot – we also know that’s not the case.

Pay attention to trends and do your best to understand current market conditions. You need to understand why you are making/losing money and when it is time to adapt.

Adapt

The best traders adapt. They pay attention to what is working and tailor their strategies accordingly.

They double down on strengths and eliminate weaknesses.

If you want to be a successful trader, you need to adapt in every sense of the word. Adapt your strategy to increase profitability and adapt to changing market conditions.

We’re in this for the long haul and market dynamism is a given. Get in the habit of adapting and constantly striving for improvement.

So, I went all fomo today and won. It was my first 500€ day. On a 2k€ account. 20-25% plus with running with Robinhood traders that just want shit to fly and buy any and all dips.

It was maybe not an educated option but I thought that if all those people are hyping it, I only need to get out before it drops. Did 10 trades on it. Every single one with a little gain. Trying to ride the waves up. Worked sometimes, sometimes it didn’t. I could have gained more had I stayed in from early in the day but what I did was really low risk.

I still think I learned a lot today.

Nath

Thank you mate.

I feel on track after reading that.

I have just finished 3 months of soaking it all up and fomo was a thing, but i have only placed 2 trades in options –

So much to knowledge to navigate and consume out there.

But i am still on my way to you.

Having a mentor is so impotent, but I made a 100% decision in Dec to gain a new skill.

because its only Me / (YOU) that can make that change.

Kind regards

Brad

Knowledge and strategies are definitely an asset, but at the end of the day, there’s no rhyme or reason, time or season in stock trading.