Day Trading Encyclopedia

Level 2 Bid, Ask, and Spread

Bid/Ask/Spreads

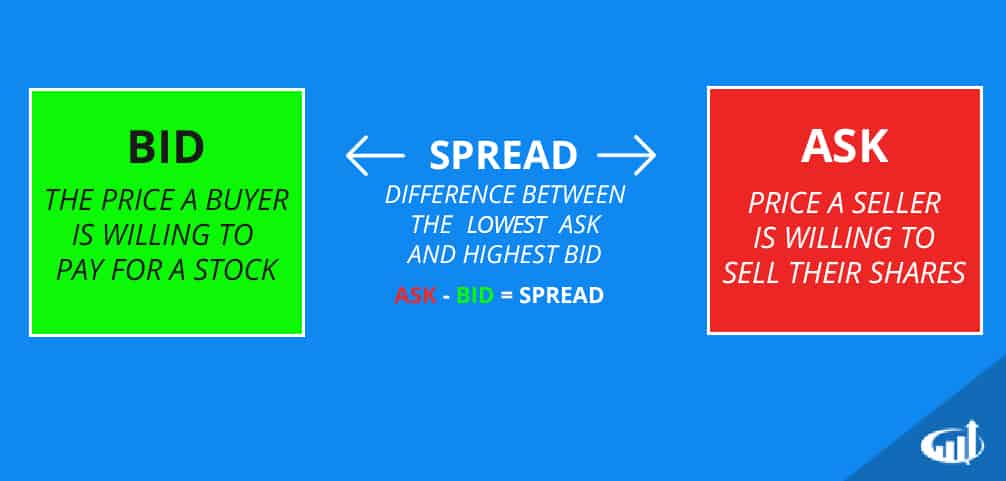

Bid Definition: A stock’s bid is the price a buyer is willing to pay for a stock. Often times, the term “bid” refers to the highest bidder at the time.

Ask Definition: The ask price is the price a seller is willing to sell his/her shares for. Often times, the term “ask” refers to the lowest selling price at the time.

Spread Definition: The spread is the difference between the ask and the bid, calculated by subtracting the bid price from the ask price. For example, if a stock had a high bid of $10.50 and a low ask of $10.60, the spread would be $0.10.

The bids are on the left side of the level 2 screen. The price difference between the best bid and best ask is known as the spread. A tight spread usually has only a one-penny difference. The larger the price difference makes for the wider the spread. Thin stocks tend to have wider spreads and thick stocks have tight spreads. The more expensive a stock trades, the wider the spreads can also be as liquidity thins out. Stocks like CSCO in the $20s usually have one-cent spreads whereas a stock like PCLN priced in the $1200s will have spreads as wide as a $2.00. The spread can be a cause for slippage. Tighter spreads favor market orders whereas a market order on a wide spread could reap a lot of slippage.

Bid, Ask, and Spread